A constantly changing world

The proliferation of inter-connected crises is causing upheaval to our landscape and making risk management more complex. Studying emerging risks is therefore needed if we are to anticipate and better prepare for the future.

CNP Assurances' role as a public insurer comes with its position as a major public financial institution. As such, the company’s job is to support our customers in managing their risks and to contribute to the protection of society more broadly.

Each year, CNP Assurances identifies the risks most likely to materialise in the next 10 years. This research is based on:

- Intelligence gathering, forecasting and strategic analyses,

- Discussions with our in-house experts,

- Surveys of a group of specialists.

Improving our understanding of this complexity

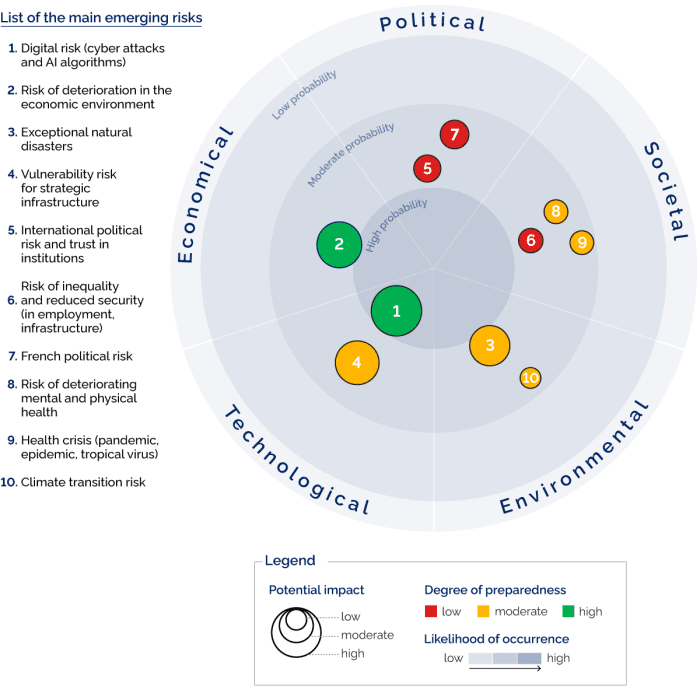

There are three key criteria for assessing emerging risks:

- The likelihood of occurrence,

- The scale of potential impact,

- The company’s level of preparedness for the risk in question.

This approach makes it possible to prioritise risks and define priorities for action. The research shows all the challenges facing CNP Assurances. It stresses the importance of developing innovative solutions to adapt to an uncertain future. By anticipating risks, we can take appropriate prevention and protection measures, individually and collectively. We are making insurance even more accessible.

What is an emerging risk for CNP Assurances?

Emerging risks include:

- New unknown risks,

- Risks that are already known but changing.

They are characterised by great uncertainty and difficulty in quantifying them, and can lead to significant losses.

2025 trends: key takeaways

Our experts are continuously monitoring emerging risks through forward-looking intelligence gathering. Each year, these risks are classified according to their potential impact and their likelihood of occurrence. For 2025, the overview of identified risks provides a global picture of the challenges that lie ahead.

1 - Digital risk (cyber attacks and artificial intelligence algorithms) remains in first place

(1,2,3).

Strict regulations are being drafted to reduce some of this risk. They aim to regulate the use of algorithms and artificial intelligence (AI) in data management. For example, the AI Act in Europe(4) and SB 1047 in California(5) are major initiatives in this area.

However, it is estimated that ransomware costs will exceed $265 billion by 2031(6).

2 - In 2024, significant political and geopolitical events raised concerns about their impact on the economy. The risk of deterioration in the economic environment was ranked second among emerging risks. Fears of deterioration in financial aspects, directly affecting companies in the sector, are pervasive. This situation worsens given the interdependence with other risks, such as inequality and lower economic security. These factors could make access to insurance services more difficult and increase the risk of fraud.

3 - The risk of exceptional natural disasters remains in third place, as was the case last year. Climate events continue to seriously affect our planet: the cyclone season has devastated North America and Asia, and Europe has suffered numerous floods, particularly in Germany, France and Spain.

These phenomena illustrate the growing impact of global warming on the intensity and frequency of natural disasters, driving insurers to adapt.

- To find out more, download our detailed analysis.

It focuses on five risks: three emerging risks in the top 5 for 2024, and two risks that are gaining momentum. After defining them, we study their projected changes over 5-10 years and their impacts on the company and on CNP Assurances. Lastly, we specify the main measures put in place by the company to anticipate and limit the impacts of these risks.

Our methodology for determining emerging risks

The examination of emerging risks is based on monitoring relevant documents and cross-disciplinary analyses. This process involves teams from the Group Risk Department and the Strategic Research and Outlook Department. They collect and cross-check risk trends from all company departments.

The 2025 ranking was established by a representative group of experts from various company departments and CNP Assurances executives. They selected and assessed 17 emerging risks according to three criteria on a scale of 1 to 5:

- The likelihood of occurrence within 5 to 10 years,

- The scale of potential impact,

- The company’s level of preparedness.

1 IA Act : comment se conformer à la nouvelle loi européenne sur l’IA ?, Big média, 02/10/2024

2 Corine Lesnes, En Californie, bataille sur la réglementation de l’IA, Le Monde, 17/11/2024

3 Calif Sausalito, Global Ransomware Damage Costs Predicted To Exceed $265 Billion By 2031, Cybercrime Magazine, 07/07/2023

4 IA Act : comment se conformer à la nouvelle loi européenne sur l’IA ?, Big média, 02/10/2024

5 Corine Lesnes, En Californie, bataille sur la réglementation de l’IA, Le Monde, 17/11/2024

6 Calif Sausalito, Global Ransomware Damage Costs Predicted To Exceed $265 Billion By 2031, Cybercrime Magazine, 07/07/2023