As a responsible investor with a share portfolio, CNP Assurances has had a dialogue and voting policy with listed companies in which it invests directly since 2005.

Dialogue with companies

Our Group intends to support its climate and biodiversity strategy by encouraging companies to publish information on the risks related to climate change and biodiversity loss.

The Group would also like to improve their corporate governance in terms of the composition of the board of directors, separation of duties and executive compensation.

To do this, CNP Assurances relies on its voting policy, the information published by companies, analysis by shareholder advisory firms and dialogue with companies ahead of general meetings.

This dialogue with companies addresses ESG, corporate-strategy and financial-performance issues.

Depending on the company’s activity, the following themes are discussed:

- governance and resolutions at the General Assembly,

- transparency and quality of financial and non-financial information,

- impacts of the company's activities on climate,

- risks related to climate change,

- impacts of the company's activities on biodiversity,

- risks related to biodiversity loss,

- other social and environmental risks.

Our Group also engages in a shareholder dialogue with oil and gas companies to support them in their energy transition and ask them to immediately stop any new fossil oil or gas exploration or production projects (conventional or non-conventional).

Our voting policy

Résolutions Say on Climate*

CNP Assurances encourages regular voting on environmental strategy at general meeting, particularly for companies with a high greenhouse gas emitting activity.

CNP Assurances will vote on Say on Climate resolutions on a case by case scenario

taking into account the content of the transition plan and the following criteria:

- Carbon neutrality ambition by 2050

- Alignment with a 1.5°C scenario

- Short-term (2025) and medium-term (2030) targets

- Integration of the most material scope 3 emissions

- Integration of targets in the variable remuneration of executives.

CNP Assurances makes public its votes on all Say on Climate resolutions since 2022.

* Say on Climate consists of having shareholders vote on the environmental strategy of companies and the associated goals.

Votes at the general meetings

CNP Assurances votes at the general meetings of almost all French and European companies in its portfolio.

The principles set out in the voting policy aim to:

- defend the rights of CNP Assurances as a minority shareholder in the long-term interest of its insured parties and its own shareholders

- support the long-term valuation of the shares held

- promote sustainable development at companies of which CNP Assurances is a shareholder by supporting development strategies that account for their impact on all stakeholders.

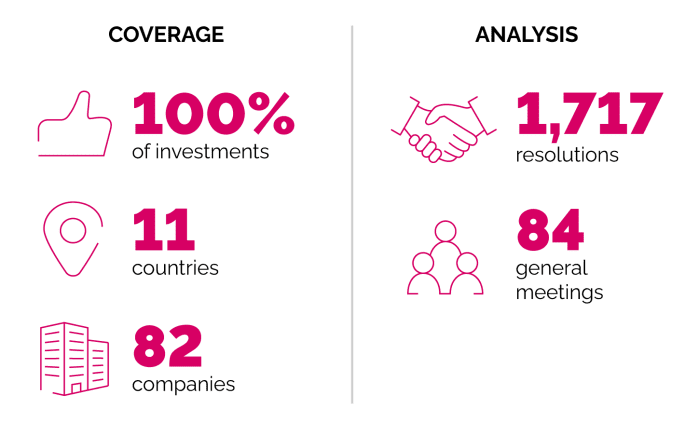

In 2024, CNP Assurances voted at 84 general meetings of 85 companies in 82 countries. These companies account for 97% of the equity portfolio held directly by CNP Assurances. Out of 1,717 resolutions, it approved 75% and opposed 25%, notably because of excessive remuneration of certain executives. Details of the votes cast by CNP Assurances by theme are available in the report on the shareholder engagement policy.