As a responsible investor, CNP Assurances takes action to have a positive impact on society as a whole. With an investment portfolio of more than €300 billion, CNP Assurances is a major player in financing the real economy. In its report on responsible investment, which is published today, the Group focuses on its commitments to protect biodiversity and climate.

Stéphane Dedeyan, Chief Executive Officer of CNP Assurances, says: “With several major events scheduled for 2021 to accelerate the protection of biodiversity across the planet, including the World Conservation Congress in Marseille in September and the COP 15 on biodiversity in China in October, CNP Assurances is committed to pursuing its efforts to measure and reduce the impact of its investment portfolio on biodiversity. I am convinced that climate change and biodiversity loss are inseparable challenges that must be addressed together by governments, companies and investors.”

• Biodiversity in shareholder dialogue

In 2020, CNP Assurances included biodiversity in its shareholder engagement policy, encouraging investee companies to take and implement ambitious decisions to protect biodiversity and publish information on the risks associated with the loss of biodiversity.

Last year, biodiversity protection issues were discussed in 64% of CNP Assurances’ meetings with companies in which it is a shareholder.

• Biodiversity in our equity and bond investments

In May 2020, CNP Assurances joined the coalition of institutional investors calling for the creation of biodiversity impact assessments for investment portfolios, which would observe principles in terms of methodology transparency.

CNP Assurances performed an initial test to measure the biodiversity footprint of its investment portfolio using the Corporate Biodiversity Footprint tool. The test carried out on five sectors (agri-food, oil and gas, energy, forests and paper, waste) estimates the biodiversity footprint of our equity and corporate bond portfolio at -14 m².MSA1 per thousand euros invested at the end of 2020.

While acknowledging the limitations of the methodology used, CNP Assurances decided to publish this first biodiversity footprint assessment to help advance methodological work in this area and encourage investee companies to increase transparency on biodiversity issues, particularly in sectors with the greatest impact.

• Biodiversity in our woodland investments

The renewal of the management mandate assigned to Société Forestière, which sustainably manages CNP Assurances’ 56,488 hectares of woodland assets, provided for an action plan and biodiversity conservation objectives covering the next five years in a sustainable management charter.

This charter provides for an inventory of potential biodiversity, with the aim of improving biodiversity by preserving micro-habitats, developing green corridors, protecting the reproduction of species the most at risk, banning fungicides and phytocides, and restricting the use of insecticides to health emergencies alone.

Société Forestière has undertaken to regularly retain both standing and fallen ageing or dead trees in our forests as they host very specific biodiversity (more than a quarter of woodland animal and fungal species) recognised as being of major interest by scientists and nature protection associations. The biodiversity protection measures applied in CNP Assurances’ forests in 2020 include the implementation of a management process to protect the wood grouse in the Jura region: Société Forestière applies tranquillity clauses to limit the disturbance of birdlife, and more specifically wood grouse, from 15 December to 30 June, and preserves the fir trees these birds feed on when they are identified.

• Biodiversity in our property investments

Real estate has a significant impact on biodiversity during both the construction and operation phases. CNP Assurances has published a “Green Works” charter imposing rules on its real estate portfolio management companies to protect biodiversity, such as respecting ecosystems during the construction phase, choosing materials that have a limited impact on the environment, and reducing waste and water consumption.

The charter also provides for the study of technical solutions that favour plants and promote biodiversity, the circular economy (reuse of materials) and ecosystem services for buildings and green spaces.

• Carbon footprint

At the end of 2020, the carbon footprint (scope 1 and 2 emissions) of CNP Assurances’ directly held equity and corporate bond portfolio is estimated at:

• 5,409,216 teqCO2, down 8% compared to end-2019

• 67 kgeqCO2 per thousand euros invested, down 16% compared to end-2019

In the interest of transparency, for the second consecutive year, CNP Assurances is publishing the breakdown of its carbon footprint by sector and by country of incorporation of the investee companies. The three biggest contributing sectors (utilities, energy and materials) account for 82% of its total carbon footprint. The three biggest contributing countries (France, United Kingdom and United States) account for 63% of its total carbon footprint.

To further its efforts to decarbonise its portfolios, CNP Assurances has committed to reducing the carbon footprint of its directly held equity and corporate bond portfolio by a further 25% between 2019 and 2024. This 25% reduction target over five years is in line with IPCC’s 1.5°C temperature rise trajectories2.

• 2025 climate targets

Having joined the Net-Zero Asset Owner Alliance3 in 2019, and in order to achieve a carbon neutral investment portfolio by 2050, CNP Assurances set in February 2021 ambitious new climate targets for 2025, aligned with current scientific knowledge:

• To reduce the carbon footprint (scope 1 and 2 emissions) of its directly held equity and corporate bond portfolio by an additional 25% between 2019 and 2024

• To reduce the carbon footprint (scope 1 and 2 emissions) of its directly held property portfolio by an additional 10% between 2019 and 2024

• To reduce the carbon intensity (scope 1 and 2 emissions) of the electricity producers in which CNP Assurances is a direct shareholder or bondholder by a further 17% between 2019 and 2024

• To engage with eight companies (six directly and two via the Climate Action 100+ initiative) and two asset managers to encourage them to adopt a strategy aligned with a 1.5°C global warming scenario by the end of 2024

• Doubling of green investments between 2018 and 2023

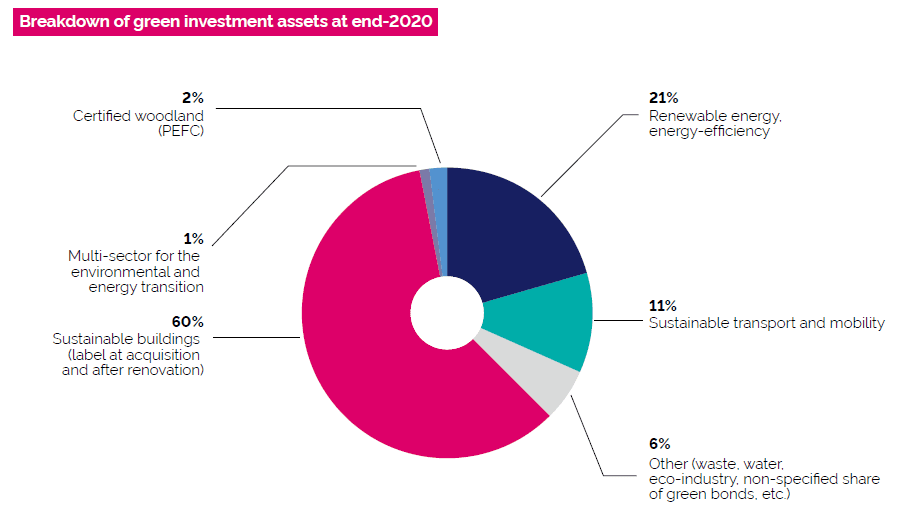

In 2019, CNP Assurances announced that it intends to double its green investment assets under management – woodlands, green bonds, high energy-performance buildings and green infrastructure – to €20 billion by the end of 2023, up from €10.4 billion at the end of 2018. At the end of 2020, its green investment assets under management amounted to €17.2 billion: 60% relate to sustainable buildings, 21% to renewable energy and energy-efficiency, and 11% to sustainable transport and mobility.

CNP Assurances’ 2020 report on responsible investment is available here

1 MSA (Mean Species Abundance) is a scientifically recognised metric created by the Netherlands Environmental Assessment Agency (PBL) to measure the average abundance of species. The destruction of biodiversity is expressed as a negative value of MSA.m². The MSA.m² corresponds to the artificial development of 1 m² of virgin natural space.

2 IPCC Special Report on Global Warming of 1.5°C: trajectories with no or low risk of global warming exceeding 1.5°C, also referred to P1, P2, P3 trajectories