In each dimension of our society, the increasing number of crises – related to health, politics, the economy and the environment – raises questions on the trend in risks. Given the severity, scale or increasing intensity of these risks, we may need to adopt a new framework for analysing them. With an overload of information and multiform potential threats, studying emerging risks requires us to qualify and prioritise, harnessing our expertise and a set of convictions.

As a complete insurer, CNP Assurances commits technical and human resources every year to prepare ahead for risks. It is thus able to explore solutions commensurate with the needs of customers. With its status as a citizen-focused insurer, conferred by the major public financial group1, CNP Assurances offers protection mechanisms that push the boundaries of insurability.

To that end, our Group is drawing up a list of:

- emerging risks,

- rapidly evolving risks,

- new risks likely to arise in the medium term.

This list provides avenues for discussion and foresight to prepare both individually and collectively for tomorrow’s world. The Group’s overview of identified risks provides a global view of the challenges in store in the coming years. These risks are highly uncertain, difficult to quantify, and may have a substantial impact in terms of losses.

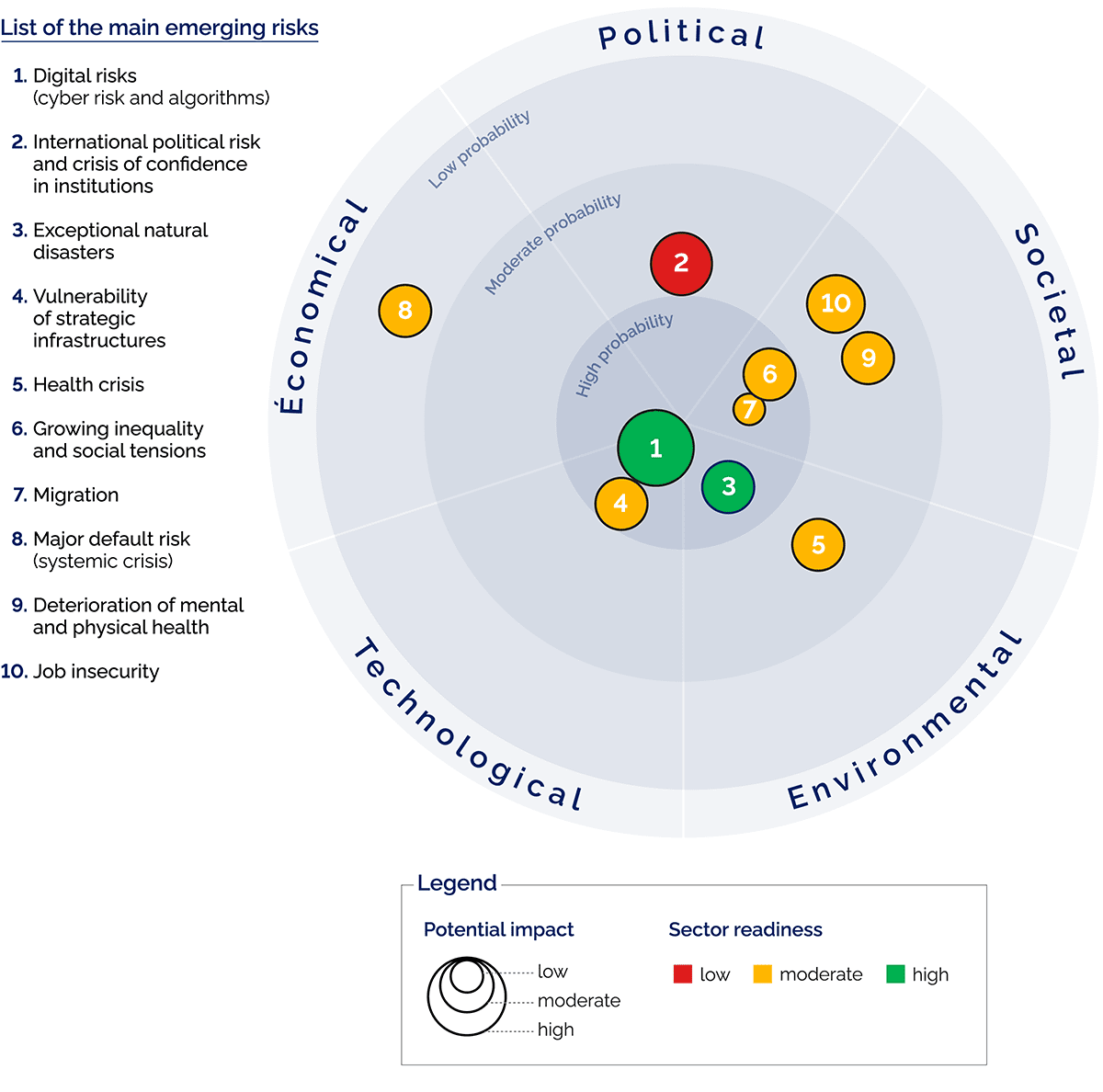

Below is our ranking of the top ten emerging risks, with a summary of the top three. You can also download a PDF document on our forward-looking analysis of each of the top three risks, with:

- background information and major events in 2023,

- the potential impacts for insurers,

- the outlook through 2030.

2023 trends: key takeaways

Our experts continuously monitor emerging risks through a forward-looking watch system. Each year, emerging risks are classified according to their potential impact and occurrence. For 2023, the overview of identified risks provides a global view of the challenges that lie ahead.

In 2023, digital risks (cyberattacks and uses of artificial intelligence algorithms) rank number-one. These digital threats generate specific risks that can compromise the security of natural and legal persons alike. Attacks targeting small businesses have increased significantly. Almost 2 in 5 have been victims of a cyberattack, up 50% in the last three years2.

International political risk and a crisis of confidence in institutions rank as the number-two emerging risk. This risk is illustrated by increasing public distrust of institutions and the rise of populist movements against a backdrop of growing geopolitical instability. In 2023, this increasingly significant risk was embodied in the persistent conflict in Europe and the resurgence of tensions in the Near and Middle East.

The number-three emerging risk is exceptional natural disasters. Disasters of substantial scale occurred around the world in 2023. The earthquakes in Morocco and the Middle East were devastating, destroying many of the homes in the affected areas. Torrential floods in Libya and France (from the north to the centre-west) also wrought substantial damage.

- To find out more, download our detailed analysis of these 3 emerging risks.

The methodology used to list emerging risks

Emerging risks are analysed on the basis of documentary watches and multidisciplinary cross-analyses. Information is cross-checked by the teams of the Risk Division and the Research and Strategic Foresight Department of CNP Assurances. The latter report on risk trends to all the company's departments.

To forge a cross-functional view of future trends and risks, an annual survey is carried out with a representative panel composed of risk management experts and directors of CNP Assurances. In 2023, a selection of 17 referenced emerging risks was submitted to the panel,which was asked to rate them on a scale of 1 to 5 based on three criteria:

- the probability of occurrence within 5 to 10 years,

- the potential impact,

- the degree to which companies in the sector are prepared.

1 The remit of France’s major public financial group is to respond to the major challenges facing society by harnessing the combined expertise of La Banque Postale, Caisse des Dépôts, Bpifrance and CNP Assurances to reduce territorial divisions and finance the economy and major public service projects.

2 Download the Hiscox 2023 Cyber Risk Management Report