Priority No. 2: reduce the carbon and environmental impact of products

The fight against climate change is only effective if it is made central to business. A signatory to the Kyoto Statement of the Geneva Association several years ago, CNP Assurances worked hard in 2015 to gain the fullest picture possible of the carbon impact of its products, on the insurance side and on the investment side alike. It also gave noteworthy support to the “Declaration of the actors of the Paris financial centre on climate change”.

Caixa Seguradora incorporated the management of environmental risk resulting from its activities and operations into its sustainable development policy in 2015, which covers identification, assessment of negative impacts, mitigation and control.

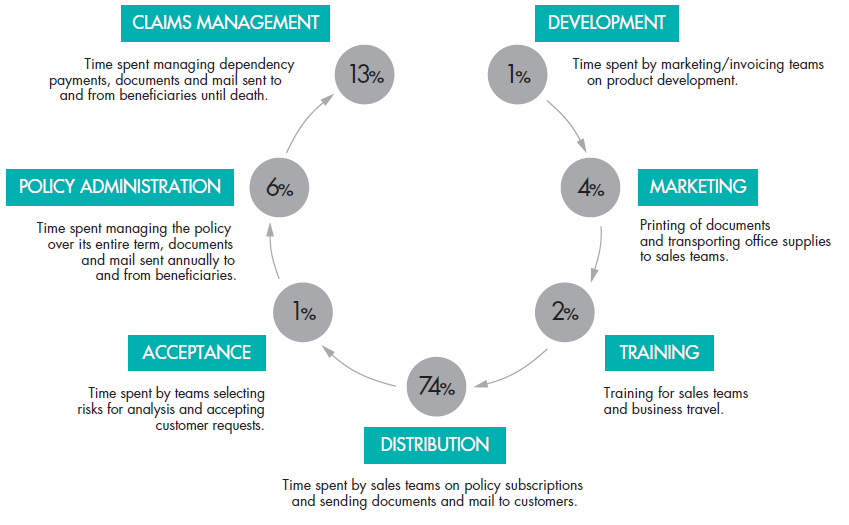

Impact of an insurance product

The cradle-to-grave carbon emissions associated with a death and disability insurance product were revised in 2015, in line with the carbon analysis method®. For example, a Trésor Prévoyance Garantie Autonomie policy generates 22 kilograms of CO2 over its lifetime, as follows.

- 1% : Development. Time spent by marketing/invoicing teams on product development.

- 4% : Marketing. Printing of documents and transporting office supplies to sale teams.

- 2% : Training. Training for sales teams and business travel.

- 74% : Distribution. Time spent by sales teams on policy subscriptions and sending documents and mail to customers.

- 1% : Acceptance. Time spent by teams selecting risks for analysis and accepting customer requests.

- 6% : Policy administration. Time spent managing the policy over its entire term, documents and mail sent annually to and from ben

- 13% : Claims management. Time spent managing dependency payments, documents and mail sent to and from beneficiaries until death.

We used the results of this analysis to set priorities for action, leading to our current work on reducing the environmental footprint of our internal operations, promoting paperless solutions and online tracking.

These findings were confirmed in 2015 by measuring the environmental impact of the online subscription in place in creditor insurance for over a year. The results are very positive, particularly in terms of greenhouse gas emission reductions.

Paper consumption for internal purposes

| 2015 | 2014 | Year-on-year change | Level of coverage | |

|---|---|---|---|---|

| Paper consumption for customers (1) | 116 million sheets | 86 million sheets | + 34% | 97% |

| Proportion of paper certified as environmentally sustainable (2) | 89% | 90% | - 1% |

97%

|

(1) Paper use for contractual documents, claims management and customer communication

(2) All paper, excluding chemical carbon paper limited to contractual documents

The increase in paper consumption for customer purposes is attributable chiefly to the increase in the amount of customer correspondence required by changes to regulations. A total of 103.4 million sheets of paper were purchased for CNP Assurances’ corporate brochures and contractual documents. In 2009, the switch to double-sided printing for informative documents sent to CNP Assurances customers helped reduce the volume, with the number of printed sheets down 42% in 2009 and 26% in 2010. Customer correspondence has been printed in part on recycled paper for the last two years. Moreover, CNP Assurances’ corporate brochures accounted for 369,719 sheets, down 20% in 2015.

For several years, some Group entities, including Caixa Seguradora, CNP Partners and MFPrévoyance, have outsourced the printing of their contractual documents and/or customer correspondence.

Eighty-nine percent of paper used by the Group (including for internal purposes) has a sustainable management label such as FSC, PEFC or EU Ecolabel.

Paperless operations – a rapidly expanding approach

The digital conversion of certain documents and procedures has increased at CNP Assurances: the Amétis network started going paperless for marketing correspondence in 2011. Virtually all applications for La Banque Postale products are now paperless. This has helped eliminate the use of carbon paper (a saving of 1 million sheets). Semi-annual customer statements are now paperless, reducing the number of items sent by the Caisse d’Epargne and La Banque Postale networks by 3 million and 1.9 million respectively.

CNP UniCredit Vita launched two projects to make its contractual and aftermarket documents paperless in 2015. CNP Assurances Compañia de Seguros has sharply reduced the printing of contractual documents, notably by establishing a customer extranet.

The environmental footprint of financial assets

As a financial intermediary, CNP Assurances’ main challenge in respect of controlling CO2 emissions is its assets.

The environment as an investment criterion

CNP Assurances applies environmental screens to all of its equity and corporate bond portfolios, thereby prioritising, in the same way as CNP Assurances Compañia de Seguros, companies with a good environmental performance and taking into account the carbon risks and opportunities (see “Priority No.1: be a responsible investor” on page 15). It has also developed CNP Développement Durable, an SRI fund focusing on environmentally responsible investments, which is marketed through the Amétis network.

Since mid-2009, Green Rating energy efficiency assessments have been carried out on all newly acquired properties in order to estimate the cost of upgrading the properties to meet the current standards. The Caixa Seguradora group has a policy of not investing in property projects that pose a potential danger to the environment.

As the largest private owner of woodland in France, CNP Assurances helps to capture a significant quantity of CO2. As a reminder (see “Forests: an environmental opportunity”), the growth of CNP Assurances’ trees allowed the sequestering of 539,020 tonnes of carbon dioxide in 2015. After deducting timber sold or cut down during the year, a net 290,584 tonnes of carbon dioxide was added to the sequestered total. The Company responsible for managing CNP Assurances’ forestry assets has been considering how these woodlands can be adapted to cope with projected climate change over the coming decades.

A first measurement of the carbon footprint and strong commitments to fight against climate change

Estimate of the carbon footprint of the portfolio of directly held listed equities

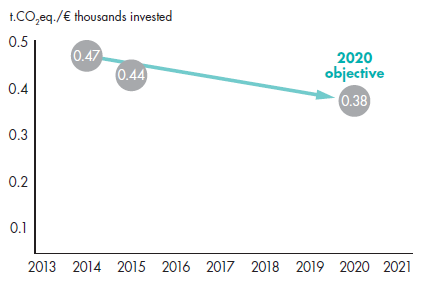

After nearly ten years of monitoring the carbon well formed by its forests, CNP Assurances elected to measure the greenhouse gas emissions from its equity securities in 2015. These emissions, despite being indirect, are far more significant than the carbon footprint emissions. Their measurement highlights the role of investors in the fight against climate change. It is a symbol more than a scientific measure. Nevertheless, CNP Assurances has set itself the goal of reducing the level reached on 31 December 2014 by 20% by 2020.

As there is still scope to improve the methodology, CNP Assurances supports the Carbone 4 methodological developments, notably with a view to better identifying companies that emit large amounts of greenhouse gases while at the same time being highly committed to CSR, via the “avoided emissions” approach. Furthermore, this measure and the associated reduction commitment strengthen the Group’s role as a responsible shareholder and reinforce dialogue with issuers. Investor leverage is becoming credible with the proliferation of market commitments to which CNP Assurances subscribed in 2015: Gold sponsor of the “climate finance days”, signatory to the Montreal Carbon Pledge, actor in the “Declaration of the actors of the Paris financial centre on climate change”, pioneer, alongside the Caisse des Dépôts Group as a whole, in the commitment to provide multi-year data on the reduction in its GHG emissions.