Priority No. 1: develop skills in line with the Group’s strategy

Human Resources planning – prudent employee management

Number of Group employees

The CNP Assurances Group had a total of 4,740 employees at 31 December 2015, representing an increase of 1% compared with 2014.

| Headcount of entities | Country | 2015 | 2014 | 2013 |

|---|---|---|---|---|

| CNP Assurances | France | 3,006 | 3,009 | 3,095 |

| Caixa Seguradora group | Brazil | 863 | 799 | 813 |

| CNP UniCredit Vita | Italy | 163 | 163 | 158 |

| CNP Cyprus Insurance Holdings | Cyprus/Greece | 285 | 283 | 290 |

| CNP Partners | Spain, Italy, France |

176 | 164 | 152 |

| MFPrévoyance | France | 76 | 76 | 75 |

| La Banque Postale Prévoyance | France | 54 | 63 | 62 |

| CNP Santander Insurance * | Irelande, Italy | 44 | - | - |

| CNP Assurances Compañia de Seguros | Argentina | 65 | 69 | 79 |

| CNP Europe Life | Ireland | 8 | 10 | 14 |

| CONSOLIDATED TOTAL - GROUP | 4,740 | 4,705 | 4,809 |

* CNP Santander Insurance is the new subsidiary acquired in 2014 with Banco Santande

CNP Assurances manages its workforce carefully, relying on the human resources planning process it initiated in 2013/2014 and expanded in 2015. CNP Assurances’ permanent workforce changed little in 2015 (-0.1%), allowing the Group to continue to grow in line with its strategy.

The stabilisation of the permanent workforce resulted from contrasting trends:

- a persistently large number of retirements, although this trend is slowing in view of the age structure and changes in regulations relating to pensions;

- constant vigilance in replacing people who leave the Company, depending on changes within the Company, in a constrained economic environment;

- external recruitment targeting new or specific technical skills related to digital, skills-based or managerial developments;

- an active policy of internal mobility, with most vacant positions filled by internal candidates.

Characteristics of headcount

| 2015 | 2014 | Year-on-year change | Level of coverage | |

|---|---|---|---|---|

| Percentage of employees with permanent employment contracts | 96% | 96% | 0% | 100% |

| Percentage of women | 60% | 60% | 0% | 100% |

| Average age of permanent employees | 43,4 years | 43,2 years | n/a | 100% |

Virtually all of the Group’s employees (98%) are covered by local insurance industry collective bargaining agreements. The only exceptions, in accordance with local regulations, are for 8 employees in Ireland and for 21 in Argentina.

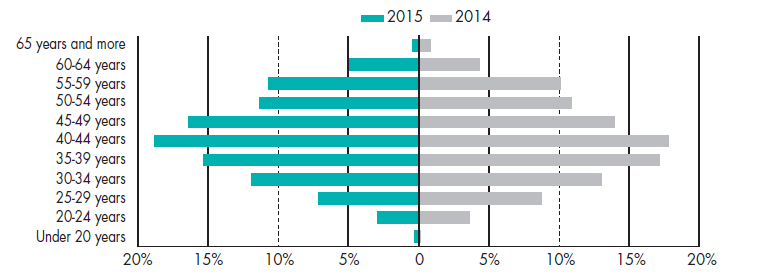

Age pyramid

| Under 20 years | 20-24 years | 25-29 years | 30-34 years | 35-39 years | 40-44 years | 45-49 years | 50-54 years | 55-59 years | 60-64 years | 65 years and more | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2014 | Under 0,5% | 4% | 9% | 13% | 17% | 18% | 14% | 11% | 10% | 4,5% | 1% |

| 2015 | 0,5% | 3% | 7,5% | 12% | 15,5% | 19% | 16,5% | 11,5% | 10,5% | 5% | 0,5% |

CNP Assurances’ workforce includes 131 civil servants seconded from Caisse des Dépôts, 58% of whom have management status. The average length of service within the Group is 13 years, and is stable compared with 2014.

A targeted hiring policy for CNP Assurances

CNP Assurances has for several years had a policy focused on internal mobility. Its twofold objective is to combine the need to manage the workforce in a more constrained environment that requires more careful management of internal career paths and to capitalise on in-house knowledge and expertise. The policy is part of the human resources planning process initiated in 2013/2014 and expanded in 2015. It results in the vast majority of vacancies being filled with skills available internally and external recruitment being focused on skills not already present within the Group.

As such, internal mobility is boosted by helping employees to develop and implement their career plans, particularly those who wish to pursue a degree (see “Training – a strong and sustained commitment” on page 25) or those who wish to move to or train for a new position. In 2015, 72% of permanent positions were filled by internal candidates, providing scope for targeted external hiring to strengthen the core skills needed to implement the Group’s strategy, to fill new positions or open up new areas of development (high-end digital skills), or to secure our processes and comply with tougher regulatory requirements.

In 2015, most of the positions open to external candidates related to finance, actuarial analysis or risk management, or to sales.

With a view to ensuring growth in digital technologies, CNP Assurances increased its visibility as an employer brand on social networks in 2015, and is now present on LinkedIn, Twitter and Viadeo.

Employees hired by the Group

| 2015 | 2014 | Year-on-year change | Level of coverage | |

|---|---|---|---|---|

| Number of new hires | 535 | 388 | +38% | 100% |

| Percentage of new hires with permanent employment contracts | 67% | 62% | +8% | 100% |

Departures from the Group

| 2015 | 2014 | Year-on-year change | Level of coverage | |

|---|---|---|---|---|

| Total departures | 462 | 473 | -2,3% | 100% |

| including dismissals | 88 | 71 | +24% | 100% |

| including terminations by mutual agreement | 21 | 13 | +61% | 100% |

| including resignations | 125 | 159 | -21% | 100% |

| including retirements | 64 | 75 | -15% | 100% |

| including departures at the en of fixed-term contracts | 154 | 145 | +6% | 100% |

| Urnover rate | 6,4% | 6,7% | -4,5% | 100% |

Turnover within the Group’s entities reflects varying situations: it is low at CNP Assurances (3.7%), and much higher at La Banque Postale Prévoyance (26%) and MFPrévoyance (11%). Caixa Seguradora maintained a turnover rate of 13% in 2015. CNP Cyprus Insurance Holdings reported a turnover rate of 3.16% in 2015, down 60% compared with 2014, despite the economic climate. Nearly one departure of a fixed employee out of every two at CNP Assurances was a retirement, which is consistent with the age structure.

Mergers/acquisitions/disposals/restructuring

Internationally, two developments impacted the Group’s scope of consolidation in 2015, within Ireland the consolidation of CNP Santander Insurance, the new subsidiary resulting from the partnership between CNP Assurances and Banco Santander, and in Spain the sale of the CNP BVP subsidiary to Barclays. None of the Group’s entities carried out a restructuring plan during the year.

A human resources planning process built over time for the benefit of the various stakeholders

Since 2013/2014, CNP Assurances has implemented a human resources planning process involving all stakeholders.

Alongside the stated policy of opening vacant positions to internal candidates, professional development was further boosted by the programme of personalised support for employees in drawing up and implementing a career plan. Thus, in 2015, more than 373 employees were able to benefit from internal mobility and 125 were promoted.

Every year, managers are asked to conduct a performance review with each member of their team. Across the Group, 96% of employees had a performance review in 2015. CNP Assurances revisited its annual appraisal interview in 2015. Now paperless, it has taken the name of “annual performance review” and consolidates this special opportunity for dialogue between manager and employee. It allows participants to summarise the events of the past year, highlight strengths and areas for improvement, and agree on expectations and objectives for the coming year.

Training – A strong and sustained commitment

| 2015 | 2014 | Year-on-year change | Level of coverage | |

|---|---|---|---|---|

| Number of training hours | 103 346 | 95 019 | +8,7% | 100% |

| Percentage of employees who received training | 88% | 87% | +1% | 100% |

At CNP Assurances, the number of training hours fell slightly in 2015, edging down by 1.2% compared with 2014, primarily due to the fact that annual performance reviews were carried out later in the year.

A wide range of training courses

The development of employees’ skills is central to CNP Assurances’ priorities, as a means of capitalising on its image and expertise, and to facilitate internal mobility. This is evidenced by training budgets, which average approximately 5% of the payroll. In 2015, more than 93% of employees attended a training course, and 67 employees were able to work towards a diploma, with a view to achieving their professional goals. Over the past three years, more than 7% of permanent employees across all levels of the Company and all areas have benefited from individual training leading to a diploma.

At CNP Assurances, training provided in 2015 covered:

- managerial skills, notably to accompany the implementation of the new annual performance review;

- support for the implementation of strategic development, support for the commercial business lines and the associated customer relationship workshops, and training for new CRM tools, or product training, and particular support this year for management profiles through technical insurance training;

- personal skills training for employees through a range of cross-cutting courses.

Lastly, the 2015 incentive scheme included awareness raising for all employees about digital culture.

CNP Assurances also factored the reform of vocational training into its processes in 2015. The most noteworthy steps were the revision of the procedure for access to degree courses in connection with the individual training account, the inclusion of the professional review and the focus on professional development.

Elsewhere in the Group, more people received training in virtually all entities in 2015. The main training areas were insurance techniques and Solvency II, followed by computer/office systems, sales and marketing, personal development, management skills and languages. In addition, during the last three years, targeted training initiatives have been organised to expand the risk management skills base. Individual training needs and requests are generally discussed during annual performance reviews. Group training needs are analysed when the annual training plans are drawn up.

In 2015, the Caixa Seguradora group developed training programmes in behavioural studies, in organisational culture and in an online course system. Encouraged by senior management, CNP Partners this year devoted more money to training, enabling 93% of employees to benefit. In 2015, CNP UniCredit Vita continued to provide training. Its diversity training, initially mandatory for all members of middle and senior management, was made compulsory for all staff. The company also tested training on smartworking and telework.

Use of outside contractors – limited and supervised outsourcing

CNP Assurances makes limited use of outside contractors for non-core business activities. There are 46 security staff, 73 cleaning staff (including regional offices), 23 maintenance workers and 8 receptionists, i.e., a total of 157 people, compared with 149 in 2014. IT operations have been transferred to an intercompany partnership established in 2012 (CNP TI), which employs 365 people.

The use of temporary staff grew significantly in volume in 2015 due to new guidelines for temporary reinforcements.

There is significant use of outside contractors at the Caixa Seguradora group and CNP Partners, which outsource their IT operations (276 contractors). Like CNP Assurances, both entities ensure that the employees concerned are accorded the full protection of applicable labour legislation (see “Priority No. 2: be a responsible purchaser” on page 19).