Priority No. 1: be a responsible investor

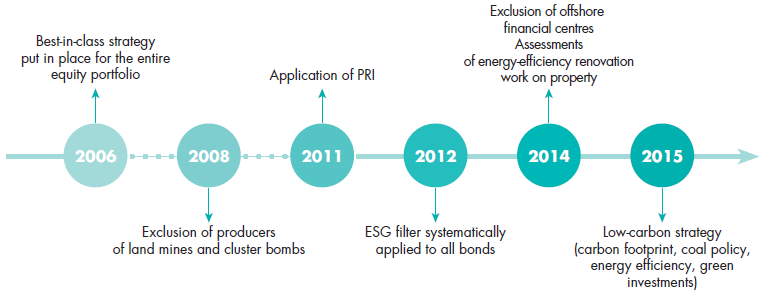

CNP Assurances’ responsible investor story

- 2006 : Best-in-class strategy put in place for the entire equity portfolio

- 2008 : Exclusion of producers of lan mines and cluster bombs

- 2011: Application of PRI

- 2012 : ESG filter systematically applied to all bonds

- 2014 : Exclusion of offshore financial centers Assessments of energy-efficiency renovation work on property

- 2015 : Low-carbon strategy (carbon footprint, coal policy, energy efficiency, green investments)

In France, a strategy combining ESG and Carbon monitoring defined by CNP Assurances and implemented by asset managers

CNP Assurances is an insurance group. As such, it manages the assets of its policyholders and its own assets, but does not manage assets for third parties, and delegates asset management activities. For CNP Assurances, the responsible investor approach is defined and managed internally by drawing on the SRI expertise of asset management companies Natixis AM and LBPAM. CNP Assurances’ strategy is applied to all of its assets and those of its French subsidiaries. The Group’s commitment to socially responsible investing was strengthened in 2011 when we pledged to uphold the Principles for Responsible Investment (PRI).

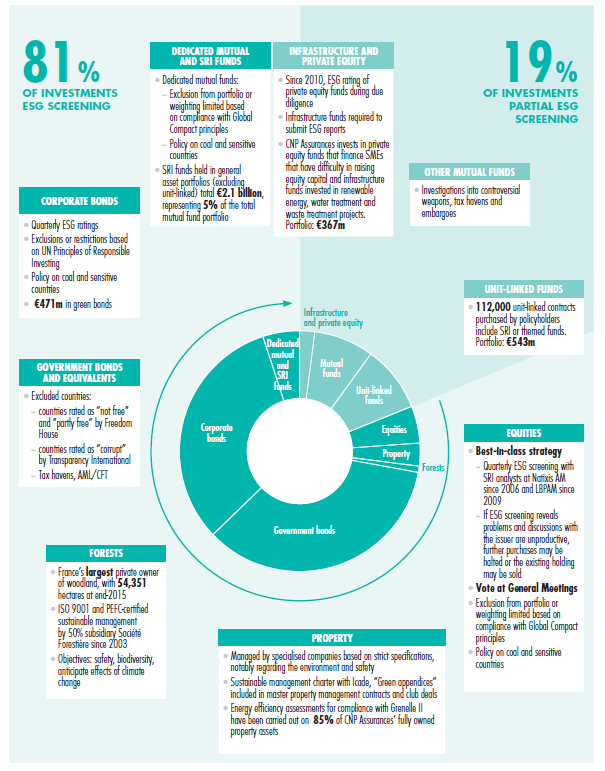

In line with our responsible investing strategy, ESG screens are gradually being applied to all asset classes across the entire portfolio, reflected in the integration of a low-carbon strategy in 2015. At 31 December 2015, the ESG filter covered 81% of the financial assets held by CNP Assurances and its French subsidiaries (see “Encouraging policyholder commitment to sustainable development“ on page 14).

Listed equities

The approach is based on best-in-class management. The establishment of a quarterly monitoring process has facilitated dialogue on securities at risk and the prevailing challenges with SRI analysts at Natixis AM since 2006 and LBPAM since 2009. Whenever a problem of non-compliance with ESG criteria is detected, constructive dialogue is engaged with the company concerned, either through our asset managers or during the lead-up to the Shareholders’ Meeting. When dialogue fails to produce results, other measures can be taken, potentially including a suspension of purchases of the Company’s securities or even their sale or exclusion.

Socially responsible investing strategy

(CNP Assurances France at 31 December 2015)

- 81% of investments ESG screening

- Dedicated mutual and SRI funds

- Dedicated mutual funds:

- exclusion from portfolio of weighting limited based on compliance with Global Compact principles

- policy on coal and sensitive countries

- SRI funds held in general asset portfolios (excluding unit-linked) total €2.1 billion, representing 5% of the total mutual fund portfolio

- Dedicated mutual funds:

- Corporate bonds

- Quarterly ESG ratings

- Exclusions or restrictions based on UN Principles or Responsible Investing

- Policy on coal and sensitive countries

- €471m in green bonds

- Government bonds and equivalents

- Excluded countries:

- countries rated as "not-free" and "partly free" by Freedom House

- countries rated as "corrupt" by Transparency International

- Tax havens, AML/CFT

- Excluded countries:

- Forests

- France's largest private owner of woodland, with 54,351 hectares at end-2015

- ISO 9001 and PEFC-certified sustainable by 50% susbsidiary Société Forestière since 2003

- Objectives: safety, biodiversity, anticipate effects of climate change

- Property

- managed by specialised companies based on strict specifications, notably regarding the environment and safety

- Sustainable management charter with Icade, "Green appendices" included in master property management contracts and club deals

- Energy efficiency assessments for compliance with Grenelle II have been carried out on 85% of CNP Assurances' fully owned property assets

- Equities

- best-in-class strategy

- Quarterly ESG screening with SRI analysts at Natixis AM since 2006 and LBPAM since 2009

- if ESG screening reveals problems and discussions with the issuer are unproductive, further purchases may be halted or the existing holding may be sold

- Vote at General Meetings

- Exclusion from portfolio or weighting limited based on compliance with Global Compact principles

- Policy on coal and sensitive countries

- best-in-class strategy

- Dedicated mutual and SRI funds

- 19% of investments partial ESG screening

- Infrastructure and private equity

- Since 2010, ESG rating of private equity funds during due diligence

- Infrastructure funds required to submit ESG reports

- CNP Assurances invests in private equity funds that finance SMEs that have difficulty in raising equity capital and infrastructure funds invested in renewable energy, water treatment and waste treatment projects. Portfolio: €367m

- Other mutual funds

- Investigations into controversial weapons, tax havens and embargoes

- Unit-linked funds

- 112,000 unit-linked contracts purchased by policyholders include SRI ot themed funds. Portfolio: €543m

- Infrastructure and private equity

CNP Assurances’ responsible investor approach for listed equity funds supports the goal of energy and environmental transition, particularly with the development since 2014 by the SRI experts in our asset management companies of a carbon risk and opportunity approach.

Since 2008, CNP Assurances has chosen to exclude equities issued by arms manufacturers whose products include land mines or cluster bombs. Since 2015, it has additionally excluded all extractive companies producing coal and coal-based energy when more than 15% of their revenue is derived from thermal coal.

Carbon footprint of the financial portfolio

In line with its commitment under the Montreal Carbon Pledge in May 2015, CNP Assurances publishes and measures the carbon footprint of its financial portfolio. The measure initially concerns the portfolio of directly held listed equities.

At 31 December 2015, the footprint is estimated at 0.44 t. eq.CO2/thousand euros invested. CNP Assurances has set a goal of reducing the end-2015 level by 20% by 2020, notably through dialogue with the companies whose shares it holds. This calculation is an estimate of Scope 1 and 2 greenhouse gas emissions by portfolio companies without adjustment for duplications, based on the portfolio’s asset value.

In addition to this indicator, which does not necessarily take into account initiatives taken to further the energy transition, CNP Assurances supports methodological developments in measuring companies’ carbon impact and their impact in respect of the environmental and energy transition, including those related to avoided emissions.

Bonds

- Government bonds and equivalents: ESG screening excludes sensitive countries rated as “not free” and “partly free” by Freedom House, and countries rated as “corrupt” by Transparency International, as well as tax havens.

- Corporate bonds: issuers are given quarterly ESG ratings, and can be excluded from the portfolio or have their weighting limited on the basis of their compliance with the principles of the Global Compact. Since 2008, CNP Assurances has chosen to exclude bonds issued by arms manufacturers whose products include land mines or cluster bombs. Since 2015, it has additionally excluded all extractive companies producing coal and coal-based energy when more than 15% of their revenue is derived from thermal coal.

Disinvestment in the coal sector

In 2015, CNP Assurances sold nearly €300 million in corporate bonds issued by companies that extract coal and produce coal-based energy. At the end of 2015, it no longer had any direct holdings of listed equities or bonds issued by companies that derive more than 25% of their revenue from thermal coal.

Mutual fund units

Companies that speculate on agricultural commodities as well as companies that manufacture cluster bombs and land mines are excluded from dedicated mutual funds. Since 2015, exclusion has been extended to the securities of companies that fail to comply with the principles of the Global Compact and the issue of coal as described in the approach taken on bonds (see above).

Surveys (the most recent, involving 64 companies, was conducted in late 2015) ensure that all the funds held by the Group, including open-ended funds, exclude producers of cluster bombs and land mines.

The issue of sensitive countries is also monitored: investigation on the treatment of tax havens and embargoes in 2015, inclusion in the due diligence questionnaire and exclusion in new dedicated mutual funds.

Furthermore, CNP Assurances has purchased SRI mutual funds in the amount of €2.1 billion, or 5% of assets of all mutual funds held at 31 December 2015. For details of policyholder investments in SRI funds, see “Encouraging policyholder commitment to sustainable development“ on page 14.

A responsible shareholder

Systematic exercise of voting rights: since 2005, CNP Assurances has followed a policy of shareholder activism by systematically voting at the Shareholders’ Meetings of the listed companies in its portfolio. In 2015, CNP Assurances voted at the Shareholders’ Meetings of companies representing 99.9% of the portfolio of French equities and around 20 European issuers. In all, we attended 102 meetings and analysed 1,892 resolutions, voting against 21.30% of the resolutions put to the vote. When we had issues with proposed resolutions, we endeavoured to talk to the companies concerned ahead of the meetings.

Voting principles are laid down by senior management. The core objective is to protect the rights of minority shareholders who are investing to support the investee’s long-term growth. Shaped in part by investor concerns, these principles are pragmatically applied to all companies in the portfolio, taking into account each one’s characteristics, industry and regulatory environment.

Sustainably managing property assets

With €10.2 billion in property assets in France based on net book values, CNP Assurances is an important player in this market. Management of its property assets is entrusted to specialised companies on the basis of strict specifications that address the need to preserve the environment and ensure the safety of the properties’ users. These include the Sustainable Property Management Charter adopted with Icade in 2008, and the establishment in 2014 of a “green works charter” to factor in the impact of all co-owned property management agreements on the environment, and on the health and safety of users.

Property assets: improved energy performance

CNP Assurances’ maintenance and renovation programmes for the property assets in the portfolio constantly aim to make the properties more energy efficient. Renovation projects are carried out to the highest environmental standards (18% of property assets under direct management are certified to HQE, THPE, BBC or Bream Very Good standards).

Since 2009, an environmental audit has been systematically carried out on all newly acquired properties. In 2015, as part of its low-carbon strategy, CNP Assurances signed the Energy Efficiency Charter for Commercial Buildings, thereby illustrating its desire to become more involved in the green building sector.

A general audit to determine an energy performance target

To meet recent requirements introduced by France’s Grenelle I and II laws, and pending the publication of the relevant enabling documents, 112 of CNP Assurances’ fully owned property assets have already been assessed to measure their energy efficiency. Action plan scenarios adapted to each building have been defined in order to reduce CO2 emissions and energy use.

CNP Assurances has already rolled out a €150 million work programme within this framework. Ultimately, this work will reduce the energy consumption of the entire property portfolio by 20% by 2020, in comparison with 2006.

Infrastructure and unlisted equities, the right vehicles for future challenges

Social information used to manage private equity and infrastructure investments since 2010

ESG ratings are awarded based on the due diligence process carried out ahead of any new private equity investment. A total of 15 private equity funds were rated in 2015. In addition, CNP Assurances has invested in several socially beneficial funds for a total amount of nearly €135 million at 31 December 2015. Examples include financing small businesses that have trouble raising capital due to social barriers, and supporting SMEs facing financial hardship.

CSR reporting is also used for new infrastructure investments. In 2015, 52% of infrastructure funds took part in this reporting or voluntarily provided their own CSR reporting.

Investments in funds supporting the energy and environmental transition

At 31 December 2015, CNP Assurances had €45 million invested in private equity funds in the clean energy, clean industry and clean tech sector. Investments in renewable energy infrastructure and water and waste treatment represented total assets of €187 million at 31 December 2015. An additional €471 million is invested directly in bonds related to specific environmental projects, or green bonds.

Thanks to progress in its low-carbon strategy in 2015, CNP Assurances achieved its initial goal and has now committed to bringing its investments in the energy and environmental transition sector to €1.6 billion by the end of 2017, a tripling of its assets between 2014 and 2017.

At the end of 2015, with management company Meridiam, CNP Assurances launched the “Meridiam Transition” infrastructure fund to finance innovative development projects related to the energy transition, local services such as heating systems or energy from recovered waste, electricity and gas networks, and innovative renewable energy. A total of €100 million had been committed at 31 December 2015.

Support for SMEs

Operating in the private equity business since 1992, CNP Assurances is one of the world’s top 50 institutional investors (number two in France) in private equity funds (2015 EPI ranking). Be they innovative start-ups or SMEs with an established presence in their market, operating in the high-tech sector or established industrial segments, these companies play a strategic role in strengthening France’s economic fabric, creating jobs and attracting foreign investment. We have continued our strategy of investing to support the real economy, both directly through co-financing deals and indirectly through specialised funds.

CNP Assurances supports businesses in difficulty through specific funds, with €128 million committed in 2015.

In addition, MFPrévoyance invested €7 million in funds supporting mid-tier companies and employment in renewable energy projects.

Forests: an environmental opportunity

Integrating environmental issues in woodland management processes

CNP Assurances is France’s largest private owner of woodland, with 54,351 hectares at 31 December 2015. Société Forestière, a 50%-owned subsidiary, applies sustainable management techniques that help to prevent fires, promote biodiversity and anticipate the effects of climate change. In 2003, in addition to ISO 9001 certification, all of CNP Assurances’ woodland assets were certified by the Pan European Forest Council (PEFC), which guarantees that the timber comes from sustainably managed forests.

Carbon sinks in France and Brazil

In 2015, tree growth in CNP Assurances’ forests helped to sequester 539,020 tonnes of carbon dioxide. After deducting timber sold or cut down during the year, a net 290,584 tonnes of carbon dioxide was added to the sequestered total.

Since 2007, the Caixa Seguradora group has been offsetting its carbon emissions by financing NGO Iniciativa Verde’s tree-planting programmes in the Atlantic forest (6,600 trees at 31 December 2015), thus earning the subsidiary CarbonFree certification. The management of these forests in accordance with biodiversity principles also provides an income for disadvantaged local communities and an opportunity for them to acquire new skills. Operations organised by CNP Assurances have added 5,704 trees to these plantations.

Anticipating climate change

In 2001, in compliance with France’s Forestry Act, CNP Assurances approved a sustainable management charter defining the commitments of Société Forestière, the company in charge of managing its woodland. These commitments include managing woodland sustainably, protecting biodiversity and proactively planning for the impact of climate change.

The climate change issue is a key factor in managing our forests. In order to ensure the long-term health and value of the woodland, the management company selects transitional tree species adapted to current and future climates and pays increasing attention to the soil moisture reserves in areas where new trees are being planted.

Protecting biodiversity

Société Forestière continued its actions in favour of biodiversity in 2015. It reinforced the monitoring of the bird population in the Gaudinière forest in partnership with the association Perche Nature. Société Forestière also prepared a management plan for the European Natura 2000 network “special protection area” in the Paradis forest (in France’s Eure et Loir department). It has undertaken to preserve birds of European significance on this site, by avoiding forestry work during their reproduction period for instance. The management plan was approved by the forestry administration in November 2015. It provides a guarantee of sustainable forest stewardship. Woodland management also prevents soil erosion and ensures water filtration and purification.

The Caixa Seguradora group’s reforestation operations promote biodiversity, protect water resources and contribute to soil conservation.

Deploying ESG screening in international subsidiaries

The Caixa Seguradora group excludes certain industries from its equity and government and corporate bond portfolios. At CNP Assurances Compañia de Seguros, when choosing among investments with equivalent risk and yield profiles, priority is given to those with the best social and/or environmental profile. At 31 December 2015, 22% of its assets were dedicated to supporting projects in the real economy or with demanding ESG criteria. In 2015, CNP UniCredit Vita applied the exclusion rules defined by CNP Assurances covering sensitive securities and countries to its bond portfolio, representing 47% of financial assets.