Priority No. 2: provide a working environment that fosters well-being and performance

The Group’s human resources policy focuses consistently on developing conditions that foster employee well-being at work and promoting personal enrichment and group performance. It relies on a significant social component and the deployment of personalised support measures for employees, and employee/employer relations combining a variety of channels.

Employee/employer relations combining a variety of channels

Employee representation and protection

Social dialogue is a priority throughout the CNP Assurances Group. There is at least one employee representative in all subsidiaries except CNP Europe Life, which has only 8 employees, and the new subsidiary CNP Santander Insurance, acquired in 2014, which has 44 employees. The Caixa Seguradora group does not have a staff delegate. However, in accordance with the rules set out in the union of insurance workers’ agreement, a representative of employees and the union president participate in meetings between employee and management representatives. Ninety-eight percent of the Group’s employees are covered by an insurance industry collective bargaining agreement (except in Ireland and for some employees in Argentina in accordance with the law). A total of 192 meetings between employees and management were held at the Group’s various entities.

Working with employee representative bodies at CNP Assurances

In keeping with CNP Assurances’ tradition and past agreements on union rights, the Human Resources department maintains regular, high-quality dialogue with the various employee representative bodies (National and European Works Councils, employee representatives and Occupational Health, Safety and Working Conditions Committee) and with union representatives, giving due consideration to the roles of everyone involved and going beyond compliance with regulatory requirements.

Agreements to improve employment conditions

CNP Assurances has agreements covering the main areas: classification and remuneration through the labour adjustment agreement, working hours (ARTT agreement), gender equality, employees with disabilities, union resources, psychosocial risks, PERCO voluntary pension plan, discretionary profit-sharing, statutory profit-sharing, etc. There is also an action plan for the intergenerational contract designed to put in place initiatives to help young people and seniors enter and stay in the workforce and develop their skills. In 2015, CNP Assurances signed an agreement within the scope of the mandatory annual negotiation, an agreement to pay additional discretionary profit-sharing, an amendment to the discretionary profit-sharing agreement, and an agreement extending the agreement on gender equality until the end of 2016.

The 2015-2018 agreement on the employment of people with disabilities: the six successive agreements already signed since 1995 have shaped corporate policy and helped change views about employing people with disabilities, implement practical measures and develop partnerships with specialised organisations. In this seventh agreement, the signatories reaffirm their commitment to promoting measures to help people with disabilities to enter and remain in the workforce. This shared political commitment is one of the human resources policies developed by CNP Assurances in keeping with the Group’s ethical, moral and civic values.

Note that two agreements were signed in 2015 at La Banque Postale Prévoyance: mandatory annual negotiation and profit-sharing. At MFPrévoyance, a collective agreement on the introduction of compulsory health insurance, a collective agreement on wages and a collective agreement on the PERCO voluntary pension plan were signed. A statutory profit-sharing agreement for employees was signed at the Caixa Seguradora group in 2015.

Spending on social matters for Group employees represented 1.6% of the payroll in 2015.

The European dimension

The European Works Council had one Ordinary Meeting in 2015 to present the report on the Group’s activities, projects and results.

CNP Assurances’ focus on managerial communication

Since 2015, the principles of action, initiative, creativity, customer focus and trust have guided the behaviour of managers and their teams.

In addition to the HR Intranet, which centralises information from the Group on its various human resources activities, managerial communication is crucial for fostering relations with employees. Over the last three years, CNP Assurances has rolled out a number of initiatives to promote the role of managers and help them to communicate with their teams. Various management circles have been identified and communication processes have been established, including conference calls with the CEO, special seminars, employee discussion forums, etc.

By way of illustration, in 2015, the seminar for 250 senior managers enabled them to work on CNP Assurances’ digital ambition.

Prevention of psychosocial risks and promotion of support systems at CNP Assurances

As a service company, CNP Assurances has paid particular attention to preventing stress and psychosocial risks over the last ten years. Through its various managerial training and other more specific initiatives (in-house social mediation, outside counselling available to all employees, independent occupational health service, etc.), it has created an environment that helps limit the occurrence of situations of risk.

It remains attentive to trends in business conduct, both in terms of information systems and expected behaviour – as regards digitisation for instance – in a changing work environment. The April 2012 agreement with trade unions on this subject provides a practical and shared framework, through the mechanisms it describes, for the identification, prevention and management of psychosocial risks.

The first review of psychosocial risks and stress provided for in the agreement was carried out in the second quarter of 2013 in order to analyse employees’ perceptions of their working conditions and their experiences. It resulted in an action plan that ran over the term of the agreement. A second audit to measure the effects of the actions undertaken was performed at the end of 2015.

An anonymous group discussion platform set out under the 2012 agreement has been in place since 2013. Managers answer the questions raised in plenary sessions and the questions and answers are then posted on the platform. Each year, 50 meetings are held within this framework.

In-house mediation: the in-house mediation service aims to prevent and deal with allegations of harassment and discrimination, stress and everyday conflicts. In 2015, it received approximately 40 referrals, most of which concerned requests for advice and support.

A dedicated commission: a commission set up under the 2012 agreement with trade union representatives on psychosocial risks (notably to handle situations involving groups of employees) meets quarterly in each of the Paris, Angers and Arcueil facilities. All employees also have access to a 24/7 hotline all year round (Filassistance), if they need to talk to someone.

Multiple initiatives in each subsidiary

All CEOs worldwide follow stress management training. The Caixa Seguradora group has also developed broad well-being at work programmes, and organises a “health in the workplace” week every year. It also has an internal committee tasked with preventing accidents, identifying risks and implementing preventive actions.

MFPrévoyance’s Occupational Health, Safety and Working Conditions Committee started paying particular attention to psychosocial risks in 2012, and a special training course has been included in the management training programme. CNP Assurances Compañia de Seguros’ code of ethics provides for the implementation of accident and occupational illness prevention programmes. CNP Cyprus Insurance Holdings has a team dedicated to regularly communicating on workplace health and safety risks, and has supported the Ministry of Labour’s “health and safety week” for several years. CNP UniCredit Vita introduced stress management for middle management in 2014. Lastly, a mutual insurer is responsible for occupational risk prevention measures for CNP Partners employees.

Organisation of working hours

Annual number of hours

At consolidated Group level, annual working hours range from 1,575 to 1,980, depending on local legislation. At CNP Assurances and MFPrévoyance, full-time corresponds to 1,575 hours per year (ARTT agreement of November 2001).

| 2015 | 2014 | Year-on-year change | Level of coverage | |

|---|---|---|---|---|

| Percentage of employees working part-time | 14% | 14% | 0% | 100% |

| Number of overtime hours | 30 534 | 23 918 | 28% | 100% |

| Percentage of overtime hours | 0,38% | 0,29% | 31% | 100% |

The subsidiaries in Italy and Brazil are the main contributors to overtime, with a significant increase in Brazil and at CNP Assurances.

Development of part-time work and flexitime

Apart from one employee at CNP Partners, all employees who work part-time within the Group’s entities choose to do so. At Group level, part-time employees represent 14% of the workforce. For CNP Assurances, 21% of employees worked part-time in 2015, with almost all of them choosing to work 80% or more of the total working time. Part-time employees are entitled to all of the same benefits as full-time employees.

In addition, 64% of the workforce at CNP Assurances have personalised working hours to help them achieve a better work‑life balance and organise their working hours in accordance with their professional obligations.

Remuneration

| Average gross salary by country | 2015 | 2014 | Year-on-year change | Average annual increase by country |

|---|---|---|---|---|

| France | EUR 57,698 | EUR 55,936 | +3.1% | 0.4% |

| Brazil | BRL 66,029 | BRL 64,337 | +2.6% | 7.4% |

| Italy | EUR 55,008 | EUR 53,778 | +2.3% | 0% |

| Cyprus/Greece | EUR 37,133 | EUR 36,052 | +3% | 0% |

| Spain | EUR 49,099 | EUR 48,668 | +0.9% | 2.24% |

| Irelande (excluding Santander) | EUR 66,933 | EUR 57,532 | +16.2% | n.c |

| Argentina | ARS 382,680 | ARS 292,122 | +31% | 31.5% |

For the consolidated CNP Assurances Group, the average pay rise was 2.15% across the board, with variations among countries due to inflation, particularly in Argentina.

At CNP Assurances, €7,161,671 was paid out under the discretionary profit-sharing plan in 2015, €17,151,466 was paid out under the statutory profit-sharing plan, and €505,586 was paid in profit-related bonuses to seconded civil servants. All CNP Assurances, MFPrévoyance and La Banque Postale Prévoyance employees are covered by supplementary health and death/disability insurance, a separate long-term care insurance policy and a life insurance/pension plan with matching employer contributions. They are also eligible to participate in a “time savings account” and invest in a PERCO voluntary pension plan.

In 2015, the Group’s compensation policy was revisited in the context of Solvency II, notably to make it compatible with the “Fit and Proper” standards.

An individual report on these issues was distributed to each employee of CNP Assurances for the first time in 2015. This approach reflects, through customised information, the Company’s determination to make its remuneration and benefits policy comprehensible, as part of its commitment to its employees.

Health and safety

Absenteeism

The Group absenteeism rate rose very slightly in 2015.

| 2015 | 2014 | Year-on-year change | Level of coverage | |

|---|---|---|---|---|

| Absenteeism rate | 6.35% | 6.28% | + 1.1% | 100% |

| Absenteeism rate excluding maternity leave | 5.39% | 5.15 | + 4.7% | 100% |

Health and safety

No occupational illnesses were reported in the Group. There were no deaths resulting from a workplace accident in 2015.

| 2015 | 2014 | Year-on-year change | Level of coverage | |

|---|---|---|---|---|

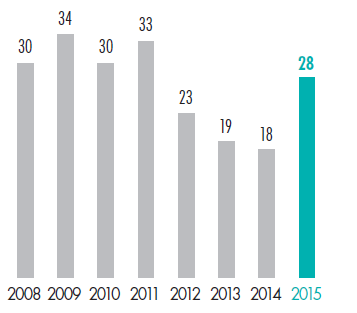

| Number of workplace accidents | 28 | 18 | + 55% | 100% |

| Occupational illnesses | 0 | 1 | -100% | 100% |

Number of workplace accidents within the Group

- 2008 : 30

- 2009 : 34

- 2010 : 30

- 2011 : 33

- 2012 : 23

- 2013 : 19

- 2014 : 18

- 2015 : 28

Almost all workplace accidents took place at CNP Assurances, and only half of them resulted in time lost, a level comparable with 2014. The CNAM-measured lost-time accident frequency rate for 2014 was 0.3% for Paris (down significantly compared with 2013), with a severity rate of 0.14%. The rate for 2015 will not be published by the CNAM until later in 2016.

CNP Assurances is committed to ensuring the health and safety of its employees. Numerous health improvement programmes have been established by Group entities: CNP Assurances has an Occupational Health department on each of its main sites, and offers employees additional preventative care from specialist doctors. A social worker is also available during office hours. The Company’s training programme includes road safety training modules for travelling insurance advisors. Prevention programmes are organised on a regular basis, and include flu vaccination campaigns.

Similar initiatives are organised by Caixa Seguradora, including consultations with an on-site nutritionist, assessments of the programme to prevent workplace risks, and on-site medical check-ups. CNP Cyprus Insurance Holdings has teams in both Cyprus and Greece responsible for informing employees about health and safety risks. CNP UniCredit Vita relies on an important Italian law that lays down a strict health and safety framework in the workplace.

Workplace health and safety agreements

In all, 98% of the Group’s employees are covered by collective agreements dealing with the main health and safety issues.

The Occupational Health, Safety and Working Conditions Committee acts on behalf of all CNP Assurances’ employees as well as outside service providers working on its premises. It meets once a month. Every year, a programme is drawn up to prevent risks and improve working conditions. A member of the Occupational Health, Safety and Working Conditions Committee is now the point person on psychosocial risks and meets with the in-house mediation team at least once a quarter. Another member is in charge of a prevention plan for outside service providers.

In addition to supplementary health insurance, CNP Assurances employees are covered by death/disability insurance with an optional long-term care formula. Collective agreements with MFPrévoyance’s Occupational Health, Safety and Working Conditions Committee also include supplementary health and death/disability insurance. CNP Partners and La Banque Postale Prévoyance also have an Occupational Health, Safety and Working Conditions Committee, which met eight times in 2015.