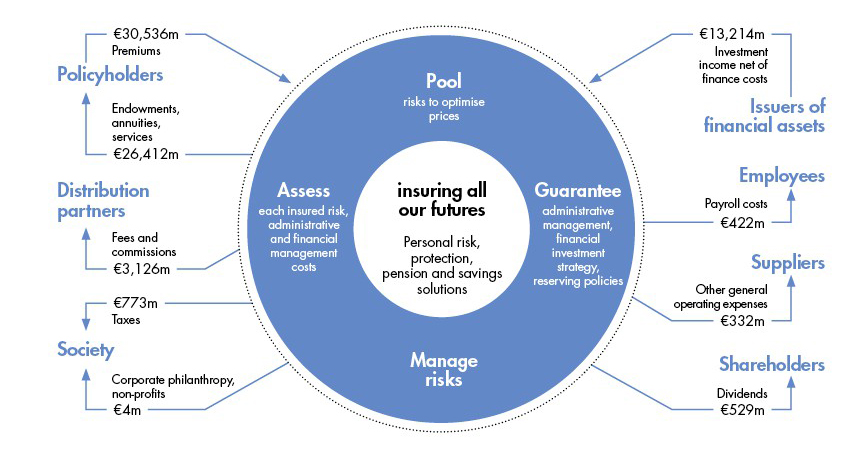

Sharing our success with stakeholders

As an insurer, investor and responsible employer, CNP Assurances creates value for its customers, its employees, its shareholders and its environment.

At CNP Assurances, we view corporate social responsibility (CSR) as a driver of transformational change and overall performance. Our CSR commitments guide our choices and inspire our everyday actions, from designing affordable offers for policyholders to training our employees and reducing our carbon footprint. We have covered a lot of ground since we pledged to uphold the UN Global Compact in 2003. The sustainable development indicators introduced in 2006 and included in the CSR report published since 2011 provide a tangible measure of our progress and of the value created for stakeholders, our customers, our employees, our shareholders and our environment.

Sharing the value created in 2014 with our stekholders

- Payroll costs paid to to employees, €422 million

- Other general operating expenses paid to suppliers, €322 million

- Dividends paid to shareholders, €529 million

- Society:

- Taxes: €773 million paid

- Corporate philanthropy, non-profits: €4 million paid

- Fees and commissions paid to distribution partners: €3,126 million

- Endowments, annuities, services paid to policyholders:€26,412 million

- Premiums paid by policyholders to CNP Assurances: €30,356 million

- Investment income net of finance costs paid by the issuers financial assets to CNP Assurances: €13,214 million

A commitment recognised by the CSR experts

CNP Assurances’S SRI RATINGS IN 2014

SUSTAINALYTICS 83/100 (August 2014)

5th/94 insurance companies worldwide

www.sustainalytics.com

OEKOM PRIME C+ (March 2013)

www.oekom-research.com

VIGEO 54/100 (2014)

7th/37 insurance companies in Europe

www.vigeo.com

A loyal shareholder base

Together, Caisse des Dépôts, the French State and Sopassure (holding company for La Banque Postale and BPCE’s interests) hold over 78% of CNP Assurances’s capital. The other 22% is held by institutional investors, around 140,000 retail investors and Group employees.

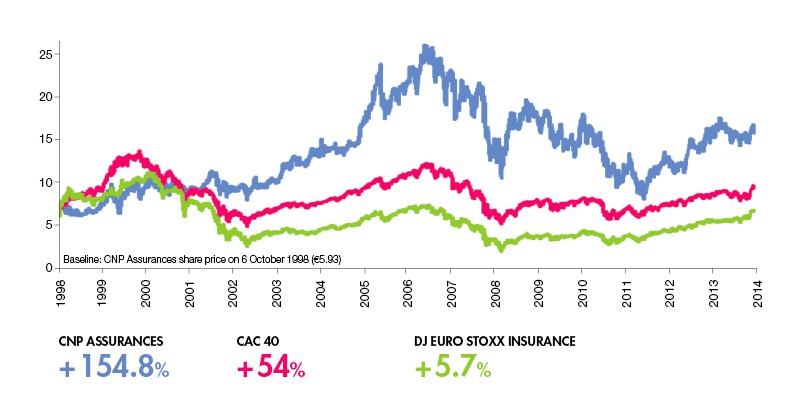

A sustainable performance

CNP Assurances share performance compared with the CAC 40 and insurance stocks from the IPO on 6 October 1998 to 20 February 2015*

- CNP Assurances +154,8%

- CAC 40 +54%

- DJ Euro Stoxx Insurance +5,7%

CNP Assurances on the stock market

- Listing: NYSE Euronext Paris since 6 October 1998

- Share price on 31 December 2014: €14.70

- Market capitalisation on 31 December 2014: €10.1bn (Source: Bloomberg)

- Total number of shares at 31 December 2014: 686,618,477

- Average daily trading volume in 2014: 288,199 shares per day (Source: Bloomberg)

Reference indices

SBF 120, Euronext 100, DJ Euro Stoxx Insurance, Ethibel Excellence Index Europe, NYSE Euronext Vigeo Eurozone 120.

FOR MORE INFORMATION

Download our financial publications and 2014 CSR report from www.cnp.fr