Focus on protection in Europe

The exclusive, long-term partnership with Banco Santander, Europe’s leading retail bank, is an important milestone in the Group’s European strategy.

In December 2014, CNP Assurances finalised an agreement with Banco Santander to build a long-term partnership based on a business model with which CNP Assurances is very familiar. The idea is to speed up growth of the insurance business through a joint venture controlled by CNP Assurances, supported by an exclusive, long-term distribution agreement. With a particular focus on personal risk and term creditor insurance, the new partnership will help CNP Assurances achieve its goal of conquering the protection market in Europe.

A broader range of protection solutions

For each of its partners, CNP Assurances designs protection products tailored to each network, responding to today’s risks of everyday life and to customers’ core concerns in each country. In mature markets, for example, we offer unemployment insurance to help insureds maintain their standard of living if they lose their job and critical illness cover providing financial support for example to cancer sufferers. We are exploring new business opportunities, such as affinity insurance for social network users and insurance packages covering an array of everyday-life risks. It’s this open approach to meeting protection needs that makes our solutions so attractive.

Access to new markets

The partnership with Banco Santander significantly extends CNP Assurances’s geographic footprint, by giving us access to new markets – Germany, Poland, Austria and the Nordic countries (Norway, Sweden, Denmark and Finland) – and strengthening our positions in Southern Europe (Italy, Spain and Portugal). Santander Consumer Finance holds leading positions in all of these countries, allowing us to immediately achieve critical mass in several important markets including Germany. The leading euro zone economy and the third largest insurance market in Europe, Germany is very similar to France in terms of its consumer finance and personal risk insurance markets.

A multi-channel distribution network

By acquiring a controlling interest in the life and non-life subsidiaries of Santander Consumer Finance, CNP Assurances has gained access to an exceptional multi-channel distribution network. In the space of ten years, Santander Consumer Finance has built a commanding position in the European consumer finance market, in the face of stiff competition primarily from subsidiaries of major French banking groups. Specialised in distributing auto loans, which account for 50% of its revenues, Santander Consumer Finance provides retail financing for the customers of over 70,000 mainly Mazda, Volvo, Kia and Hyundai dealers throughout Europe. Together with other partners such as TV and hi-fi stores, household appliance stores and major retailers, the company’s consumer finance products and services are offered through more than 100,000 points of sale in the region.

Santander Consumer Finance is also present in direct-to-consumer channels, notably through a network of 600 branches, which enable it to forge close local relationships with customers.

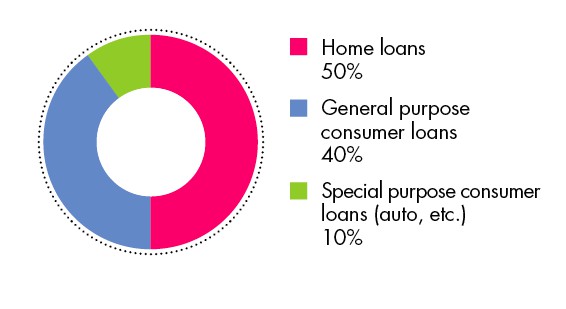

CNP Assurances’s term creditor insurance book in Europe

- Home loans 50%

- General purpose consumer loans 40%

- Special purpose consumer loans (auto, etc.) 10%

Key figures

20 years covered by the new exclusive distribution agreement.

And

100,000 Santander Consumer Finance points of sale in the ten countries covered by the agreement with CNP Assurances.

A strategic milestone

Aurélien Signorini, Finance Director - CNP Santander Insurance

“It’s very motivating to join CNP Santander Insurance just when it’s achieving a strategic milestone in its development. This young and dynamic organisation will allow us to leverage the powerful Santander Consumer Finance network, while at the same time giving the network the benefit of our expertise in the areas of protection and personal risk insurance to broaden the range of products offered to customers.”

Creating value

Joaquín Capdevila, Insurance Director - Santander Consumer Finance

“By combining the CNP Assurances Group’s technical expertise in term creditor insurance with our distribution fire-power in Europe, our partnership promises to create value for our two groups and also for our customers.”

new partner, strong growth potential

In 2015, CNP Assurances is inaugurating its partnership with Banco Santander with a shared goal of growth and innovation.

The partnership with Banco Santander illustrates two aspects of our strategy. The first is our business model’s multi-partner dimension, which is driving faster deployment of our insurance solutions and the development of our business in Europe. The second is our general refocusing on personal risk insurance, to establish a better balance between the savings and protection businesses. The complex negotiations were completed within a very short timeframe, illustrating the agility that comes from our 160 years’ experience and our forward-looking mindset.

12 million active customers

With over 12 million active customers and 30 million potential insureds, the partnership offers considerable scope for growth. In 2014, Santander Consumer Finance’s insurance subsidiaries generated premium income of €650 million. For the current year, the Group expects to write over €500 million worth of business in Germany alone. By 2019, the partnership is projected to generate €900 million in premium income and EBIT of €80 million.

Three questions for

Pierre-Nicolas Carissan, term creditor/personal risk insurance development manager in the Open Model business unit

In competitions on this scale, what really counts?

Throughout this complex journey, we obviously had to demonstrate technical excellence, for example in the areas of financial valuations and contract negotiations, but we also had to make Santander’s teams want to work with us.

What struck you the most about Santander?

We were impressed by the professional qualities and enthusiasm of the Santander Consumer Finance teams that we met during the process. This partnership is an outstanding opportunity for CNP Assurances to join forces with a leading consumer finance provider.

What is CNP Assurances’s recipe for success?

Create a joint venture and set up an exclusive, long-term distribution agreement. We have successfully deployed this partnership model both in Europe and in South America and are convinced that it represents the way forward. The hallmarks of our Group – its long history, corporate DNA and solid expertise – all ensure that we can create value with a partner over the long-term.

Countdown to a successful deal

Early 2013

Strategic plan

European expansion becomes a strategic goal, with plans for faster growth in Southern Europe and penetration of new markets, starting with Germany.

Autumn 2013

Exploratory talks in Germany

A review of partnership opportunities is launched. We are invited to examine a possible partnership with a European bank heavily involved in consumer finance, which accounts for 50% of its business in Germany. We accept the invitation. Santander is talking to several major international insurers. The competition is on.

February 2014

Initial discussions and start of the process.

9 july

Signature of the MOU concerning the partnership and acquisition of the subsidiaries.

16 december

Signature of the final agreements, after obtaining the go-ahead from the Bank of Ireland, the acquired subsidiaries’ country of incorporation, and from the European Commission.

17 december

First meeting of the Board of Directors of the joint venture in Dublin, to approve the 2015-2019 business plan prepared jointly by the two partners since July.

2015

Dublin

CNP Assurances will gradually take over control of CNP Santander Insurance’s Irish companies. The team of around forty people in 2014 will be expanded notably through the transfer of CNP Assurances employees to facilitate the integration process and accelerate their development.