2014, solid financial performance and business transformation

In an environment shaped by historically low interest rates, our good performances confirm that we were right to rebalance our multi-partner model by increasing our focus on personal risk/protection insurance and long-term unit-linked savings.

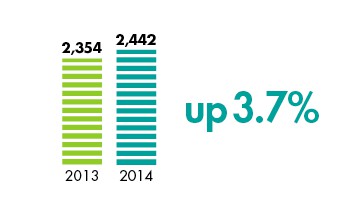

Total Revenue (Net insurance revenue + Revenue from own-funds portfolios)

€3,337m, up 3.2%

In France, the 1.1% growth in net insurance revenue was the net result of contrasting trends, with a 2.2% fall in the savings and pensions segment, due in particular to the fall in interest rates, and an 8.8% rise in the personal risk/protection segment.

In the “Europe excluding France” region, net insurance revenue rose by 11.5%, helped by our swift response to the low interest rate environment.

In Latin America, momentum remained strong, with net insurance revenue up 16.7% like-for-like (7.1% including the currency effect), led by the personal risk/protection segment.

Net insurance revenue from own-funds portfolios was stable at €775 million.

Consolidated Ebit

- 2013 : 2354

- 2014 : 2442

- up 3,7%

€2,442m

The growth in EBIT attests to the Group’s robust operating performance in a difficult macro-economic environment.

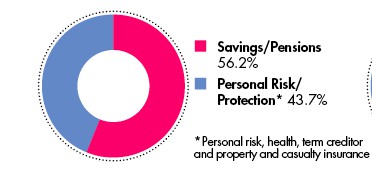

Ebit by segment (in %)

- Savings/Pensions 56.2%

- Personal Risk/Protection* 43.7%

* Personal risk, health, term creditor and property and casualty insurance

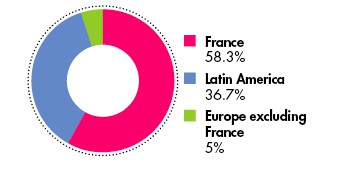

Ebit by geographic area (in %)

- France 58.3%

- Latin America 36.7%

- Europe excluding France 5%

Attributable net profit

€1,080m, up 4.8%

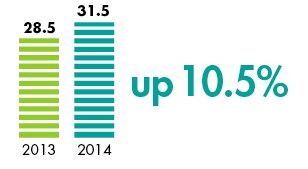

New money €31.5bn (french gaap)

- 2013 : 28,5

- 2014 : 31,5

- +10,5%

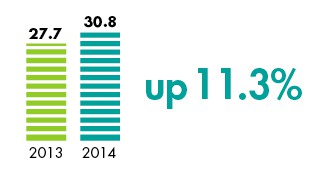

Premium income €30.8bn(ifrs)

- 2013 : 27,7

- 2014 : 30,8

- +11,3%

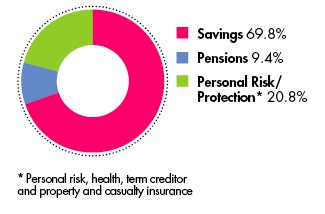

Premium income by segment (in %, IFRS)

- Savings 69.8%

- Pensions 9.4%

- Personal Risk/Protection* 20.8%

* Personal risk, health, term creditor and property and casualty insurance

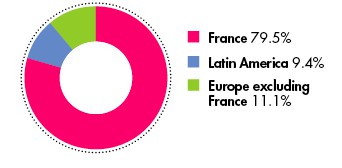

Premium income by geographic area (in %, IFRS)

- France 79.5%

- Latin America 9.4%

- Europe excluding France 11.1%

Embedded value (MCEV©: Market Consistent Embedded Value)

€25.5 per share, up 13.5% from the 31 December 2013 figure after dividends.

Solvency I

403% capital coverage ratio (118% excluding unrealised gains), attesting to the Group’s strong capital base.

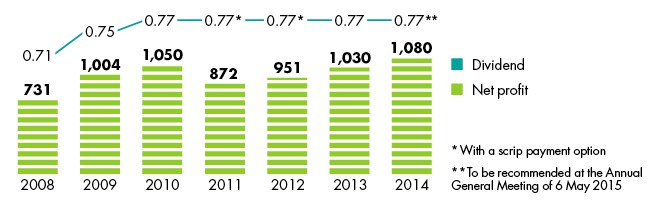

Overview of net profit and dividends

(In € per share and € millions for profit) from 2008 to 2014

At the Annual Meeting of 6 May 2015, the Board of Directors will recommend paying a cash-only dividend of €0.77 per share for 2014.

- 2008 : €731m - €0,71 per share

- 2009 : €1,004m - €0,75 per share

- 2010 : €1,050 - €0,77 per share

- 2011 : €872 - €0,77 per share (With a scrip payment option)

- 2012 : €951 - €0,77 per share (With a scrip payment option)

- 2013 : €1,030 - €0,77 per share

- 2014 : €1,080 - €0,77 per share (To be recommended at the Annual General Meeting of 6 May 2015)