Insurance for all in Brazil

CNP Assurances has been present in Brazil for 14 years, enabling as many people as possible to benefit from its insurance protection through Caixa Seguradora.

The world’s seventh largest economy, with a population of 204 million and less than 5% unemployment, Brazil is a promising market that has retained its momentum despite experiencing slower growth.

110 million potential policyholders

Year by year, the economic model lifts more and more Brazilians into the middle class, enabling them to increase their spending on consumer goods and services in general and insurance in particular. At the end of 2014, an estimated 110 million Brazilians were classified as middle class, representing 54% of the population. All of these people are potential buyers of affordable insurance products. For the lowest earners, micro-insurance offers protection against specific risks in exchange for a very low regular premium, for example less than €1 per month.

By attenuating the effects of the crises of everyday life that can plunge families into poverty, such as the death of the breadwinner, a funeral, critical illness or theft, micro-insurance helps to consolidate upward mobility and contributes to the country’s sustainable economic development.

A partner at the centre of social policy

We began offering insurance products to Brazil’s middle class in 2001 through our subsidiary Caixa Seguros – now named Caixa Seguradora – that we own jointly with Caixa Econômica Federal. Brazil’s second largest state-owned bank and one of the country’s most important financial institutions, “la Caixa” is the preferred bank of first-time savers. It distributes the bolsa familia family allowances, manages the unemployment insurance system and finances three-quarters of loans to first-time home-buyers. With 4,000 branches and 20,000 “Caixa aqui” (Caixa here) correspondents, it has a local presence throughout the country. La Caixa also manages over 12,000 national lottery sales booths located in many cases in the centre of low income communities. Its brand equity and popularity prepared the terrain for the launch of Caixa Seguradora’s insurance offer and have contributed to its success.

Affordable, accessible offers

With Caixa Seguradora, you don’t need a bank account to purchase protection insurance and savings products. Caixa Seguradora was the first Brazilian insurer to offer simple and affordable products covering personal and property risks, as well as savings products that combine capital-building with random draws.

Since their launch in 2000, five million micro-savings contracts have been sold. In this segment, a volume-driven strategy is out of the question. The inclusion of death/disability cover in savings products makes them more useful and attractive to policyholders, while helping to protect Caixa Seguradora’s margins.

In Brazil, as in Europe, the Group is focusing on personal risk insurance. Several million Brazilians have already purchased these products which are being made increasingly attractive. Conjugado combines personal risk insurance, a micro-pension plan and a random draw feature that gives policyholders the chance to receive a small windfall. Amparo funeral insurance, which can be purchased in a matter of seconds, provides the assurance of a decent burial in exchange for a monthly premium of just a few reals.

Helping Brazilians to fulfil their aspirations: a home and healthcare

Brazilians’ number one dream is to own their home. Caixa Seguradora is helping 4.7 million of them to fulfil this dream. Having a health plan is also high on their wish-list, ahead of owning a car. One of the highlights of 2014 was the acquisition of Tempo Dental, giving Caixa Seguradora access to a vast network of dental health professionals and a portfolio of some 600,000 customers. The potential market is very large, given that over 20 million Brazilians have never visited a dentist. Caixa Seguradora is in a position to meet their needs by offering a high quality service at an affordable price throughout the country. The acquisition of Tempo Dental has lifted the Group to a position among Brazil’s top five providers of dental insurance, by strengthening its dedicated healthcare platform, Caixa Seguros Saúde.

Distribution, the crux of the matter

Caixa Seguradora distributes its insurance products through the 60,000 Caixa sales points (branches, Caixa aqui correspondents, bank terminals and lottery booths), and also through a network of around 3,000 partner brokers. The biggest-selling products, such as funeral insurance and dental insurance, are sold on-line and by telemarketing teams, two mass distribution channels that enable Caixa Seguradora to reach a far greater number of potential customers while also increasing its marketing efficiency. The website clocked up 17.5 million visitors in 2014, while the number of subscribers to on-line services grew by 38.5% over the year to 6.7 million.

Key figures

- 5 million micro-savings contracts sold since their launch in 2000.

- 30,000 micro-insurance policies sold per month on average by Caixa Seguradora.

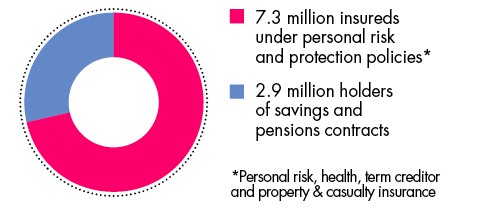

Caixa Seguradora: over 10 million customers

7.3 million insureds under personal risk and protection policies*

2.9 million holders of savings and pensions contracts

*Personal risk, health, term creditor and property & casualty insurance

Bilhete, an outstanding success

There was a buzz around the sale of the 20-millionth Bilhete contract two years ago. With its tiny premium – BRL 2.50* per month on average (less than €1) – and broad coverage starting at BRL 2,000 (around €800), the product can’t fail to please. Bilhete has propelled Caixa Seguradora to the forefront of the affordable insurance market in the communities, where most of the contracts are sold.

* As of 31 December 2014: €1 = BRL 3.12

Caixa Seguradora, acclaimed by consumers

On the ReclameAQUI platform, consumers are the only judges. This is what gives credibility to its brand ranking and explains the popularity of the site, which attracts 10 million visitors per month. Every year, two million web-users are asked to name the best companies for customer relations in various categories, including over 20,000 for the insurance industry. In 2014, for the second year running, Caixa Seguradora was named Best Insurer, receiving nearly half of the votes. A mark of recognition for the Brazilian subsidiary, which processed three million customer inquiries last year by telephone, e-mail or on social networking sites.

Expansion, Embarking on a new chapter

Caixa Seguradora’s indicators are still showing double-digit growth, but Brazil is changing and so are the aspirations of the country’s middle class. Caixa Seguradora is looking to the future.

Caixa Seguradora’s Brasília headquarters were showing their age and had become too small to house the expanding company. We therefore decided to build new offices, across the road from the existing headquarters.

A new headquarters, a new name

In late 2014, all of Caixa Seguradora’s teams moved to the new building, which symbolises the company’s new ambitions and its confidence in the future. The Brazilian subsidiary has opened a new chapter in its history. It’s an opportunity to redefine its mission, vision and values, revisit its codes and adopt a new name. Caixa Seguros means “La Caixa’s insurance”, referring to the product range. It has been renamed Caixa Seguradora, meaning “La Caixa’s insurer”, referring to a person, an expert in his or her own right. The change leverages the Caixa brand, one of the country’s strongest, and affirms CNP Assurances’s unique position within the alliance, as well as the human dimension it shares with La Caixa.

Three questions for

Gabriela Ortiz de Rozas, Marketing, Strategy and Communication Director, Caixa Seguradora

Do people in Brazil view insurance as a consumer product like any other?

We are seeing the development of an insurance culture in Brazil. Middle class people and people with lower incomes are showing growing interest in affordable insurance products. Caixa Seguradora is focusing on mass sales to meet the needs of as many people as possible.

You keep a close watch over trends in the market, how is it changing?

Brazil is changing right in front of our eyes. This can be seen from last year’s protests, which focused not on increases in benefits but on improvements to public transport and better access to education and information. Nevertheless, the insurance industry is still lagging behind consumer needs, with one of its main challenges being to simplify processes, products and communication methods. Caixa Seguradora is firmly engaged in this process.

What role can Caixa Seguradora play?

La Caixa is playing a growing socio-economic role in Brazil. We are proud of our commitment to partnering its ambitions and supporting its success.

Outlook, South American ambitions

In the past 20 years, Latin American economies have changed considerably, the local insurance markets have matured and the Group now has a good understanding of their challenges and players.

Towards an e-company in Brazil

It’s strategic. CNP Assurances has decided to give shape to its digital ambition in 2015. Brazil is the ideal place: there are a vast number of potential micro-insurance customers and digitalization of everyday life has taken place much faster than in Europe. All of Brazil’s major insurance companies are focusing on mass distribution and creating virtual stores on their websites. We have gone further by developing the concept of a 100%-digital company whose origins are in e-commerce, a pure player with the codes, practices and requirements of e-buyers. We are working on the business model and plan to go live in 2016, with major ambitions backed by significant investments. This innovation will speed the transition to multi-channel distribution, illustrating our Group’s vitality.

Conquering Latin America

The Group has been present in Latin America since 1995, when it set up its first subsidiary in the region, CNP Assurances Compaña de Seguros, based in Buenos Aires, Argentina. In the past 20 years, the local insurance markets have matured and improved living standards have helped to create significant potential for growth, by making personal risk, auto and comprehensive home-owner’s insurance more easily affordable. Today, the Argentine subsidiary is enjoying strong growth* and consolidating its position as one of the country’s leading personal risk companies. Caixa Seguradora is also rapidly growing its personal risk business, as Brazil’s fifth largest insurer in this segment.

The Group is on the look-out for new growth opportunities in Latin America, initially in Colombia, Chile and Peru. Colombia is an open market, with a history of successful development experiences particularly in bancassurance. Our market exploration began with the opening of a lean structure whose first task in 2015 is to come up with a development plan based on distribution agreements or new partnerships.

Intersecting challenges

Thierry Claudon, Head of the Latin America business unit

“We have been working with La Caixa for 14 years and have just finished preparing our 2015-2019 business plan. The plan is more ambitious, diversified and detailed than ever. These new objectives are aligned with the strategies of CNP Assurances and Caixa Econômica Federal. They should help to strengthen our Group’s position in Brazil while also increasing our enterprise value. They will also give full meaning to the cooperation between two major institutions, one French and the other Brazilian. And naturally, they should be useful to the country, which is indeed the case.”

* Its premium income rose by 20% like-for-like in 2014. See 2014 Annual Results of the CNP Assurances Group.