Question n°3

Renaud Chaumier

Director of human resources, member of the Executive Committee of LCL

Villejuif, France

Given increasing life expectancy and the economic crisis, how can you secure the income of tomorrow’s retirees?

Answer

The intergenerational gap threatens the balance of pay-as-you-go schemes.

Today, CNP Assurances offers a range of pension solutions that meet the needs of all companies, from the individual entrepreneur to very large international customers. But that is not enough.

There is an urgent need to innovate. CNP Assurances is contributing to the debate with those involved in pensions and the public authorities, in both France and Europe, to secure a regulatory framework that is more appropriate to long-term commitments, and to speed up the implementation of new solutions. It was for this ambition to become a reality that CNP Assurances, together with AG2R La Mondiale, formed a new leading player in additional pension cover.

More than 4,600 businesses from SMEs to large CAC 40 customers put their trust in CNP Assurances for personal risk and protection insurance, and for the pensions cover of their employees

20,000 local authorities and hospital authorities have chosen CNP Assurances to provide welfare protection for their officials

Thomas Béhar

Group technical director, chairman of the Society of Actuaries

The “Solvency II” standards oblige insurance providers to constitute prudential reserves, with regard to their businesses. They are unsuitable for pension activities, which by their very nature are very long-term and carry no liquidity risk. The profession is fighting for made-to-measure regulations applicable to collective contracts dedicated to pensions so as to promote long-term saving and to preserve the purchasing power of future retirees.

Specifically, CNP Assurances is in favour of the transposition into French law of the European directive on institutions for occupational retirement provision.

x2 according to the INSEE, the number of

people aged 60 and more will double between now and 2050, while the employed population will remain the same

This is an intergenerational challenge

In the last century, life expectancy in France has increased by more than 35 years on average. Between 1950 and 2000 alone, the life expectancy of a retiree doubled, from 10 to 22 years.

It has now become a second lifetime. This demographic change combined with the delayed start of employment threatens pay-as-you-go pension schemes. The establishment of an additional pension system has become unavoidable. But who will finance what? Both employees and business leaders prefer company systems to individual systems, to supplement their pensions.

Large companies already use long-term savings to support their welfare policy. Our contacts with SMEs reveal a certain number of obstacles: the complexity of the systems, their regulatory instability, and the need for advice and assistance in order to put an adequate system in place.

The company will still have to convince its employees to participate.

In fact, while a group health contract offers an immediate benefit to the insured, it is more difficult to gain insight when it comes to pensions, especially for young people, who pay more attention to increasing their purchasing power now than of safeguarding their long-term income. It is for all those involved in welfare protection to assist with the construction of tomorrow’s pensions.

€7 billion paid for additional pensions in France, a significant increase

(excluding life insurance)

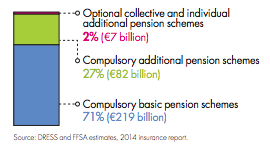

Distribution of payments made via the three stages of the pensions system in France (€308 billion)

Optional collective and individual additional pension schemes

2% (€7 billion)

Compulsory additional pension schemes

27% (€82 billion)

Compulsory basic pension schemes

71% (€219 billion)

Source: DRESS and FFSA estimates, 2014 insurance report.

The importance of innovation

Faced with the complexity of pension schemes in France, with its 35 distinct public and private schemes, CNP Assurances provides solutions adapted to each situation in order to make life simpler for the insured. The Group comes up with solutions in response to a wide range of problems, such as savings dedicated to health cover upon retirement, and services that promote prevention.

The increasing importance of digitisation is changing the way people work and inspiring new support services at CNP Assurances that are more accessible to everyone, more interactive and more easily tailored to individual requirements.

The partnership concluded in December 2015 with AG2R La Mondiale, the 2nd largest provider of additional pensions in France, and the leading additional pension provider Agirc-Arrco, confirms CNP Assurances’ intention to position itself in this sector with a major social dimension, and to be a very long-term player. The joint subsidiary, Arial CNP Assurances, provides the expertise and handles the portfolios, and becomes the leading player in additional pensions, with €12_billion under management. It strives to offer companies and their employees the best services to secure their income, to preserve their purchasing power and to access quality care after their active working life is over.