Building a sustainable world : investments that are delivering change

CNP Assurances strives to make a difference in its role as an institutional investor by making sure its portfolio is fully aligned with its values.

With over 300 billion euros invested across all sectors of the economy, CNP Assurances is a major provider of funding to the real economy and for the future of the regions. The Group ranks among the world’s top 50 institutional investors in private equity and is one of the leading players in France. Every year, it invests between 500 million euros and 700 million euros in unlisted businesses and guides them through every stage in their development.

As a signatory of the UN Principles for Responsible Investment, the Group selects its investments using environmental, social and governance (ESG) criteria. Over the past ten years, this approach has been extended to all asset classes.

With 81% of its assets screened on ESG criteria at year-end 2018 and 19% partially screened, CNP Assurances is pursuing an integrated approach as a responsible investor, with arrangements geared to the specific nature of each asset segment.

With 10 billion euros in green investments at year-end 2018 and fresh ambitions to withdraw from the coal industry, CNP Assurances is following up on its decision to become more and more engaged in efforts to combat climate change. The Group firmly believes that widespread environmental damage would give rise to a financial risk against which it has a duty to protect itself so it can honour its, in certain cases, very long-term commitments to its policyholders.

“Responsible investment is neither a constraint nor a formality, but a driver helping us to address the challenges facing our societies.”

Olivier Guigné, Group Chief Investment Officer

Major commitments in support of the energy and environmental transition

to help limit global warming to 2 °C by the end of the century.

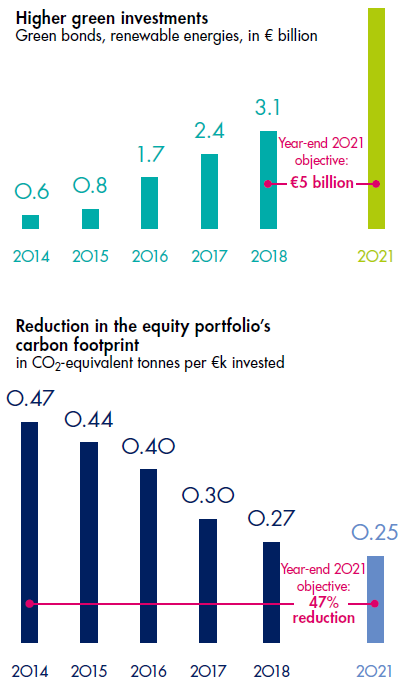

Higher green investments, Green bonds, renewable energies, in billion euros

| 2014 | 2015 | 2016 | 2017 | 2018 | 2021 |

|---|---|---|---|---|---|

| 0.6 | 0.8 | 1.7 | 2.4 | 3.1 |

From 2018 to Year-end 2021 objective : 5 billion euros

Reduction in the equity portfolio’s carbon footprint in CO2-equivalent tonnes per thousand euro invested

| 2014 | 2015 | 2016 | 2017 | 2018 | 2021 |

|---|---|---|---|---|---|

| 0.47 | 0.44 | 0.40 | 0.30 | 0.27 | 0.25 |

From 2014 to Year-end 2021 objective : 47% reduction